Banking sector remains ‘generally stable’: RBZ

The Reserve Bank of Zimbabwe says the banking sector has remained “generally stable” with two banks now having exceeded the $100 million minimum capital requirement.

The Cabinet approved $100 million minimum capital requirement is set to be effective in 2020. The monetary authority’s latest ‘Banking sector report for quarter ended June 30, 2014’, basically shows that there has been no improvement amongst the six “fragile” financial institutions, although of the banks already in compliance with the current minimum capital requirements, another bank has exceeded the $100 million requisite to make them two.

“As at June 30, 2014, a total of 14 out of 20 operating banking institutions were in compliance with the prescribed minimum capital requirements . . .

“Two banking institutions have already surpassed the minimum capital requirement targets, effective 2020,” said the RBZ.

The central bank, however maintained that it will continue to closely monitor the few banking institutions – with a combined market share of 7,36 percent – in terms of assets, which were facing liquidity and solvency challenges.

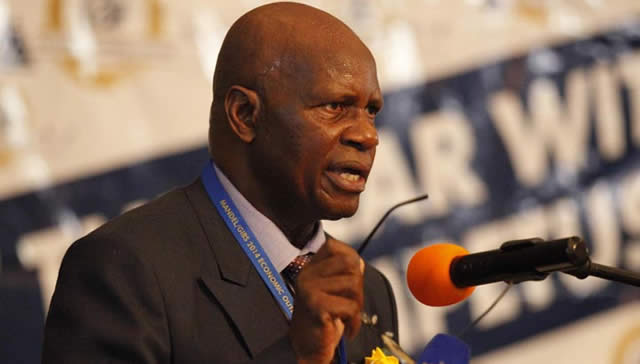

Earlier this year, Finance and Economic Development Minister Patrick Chinamasa said the few struggling banks did not pose any systemic risk to the country’s banking system.

In terms of asset quality at the broader banking sector level, the RBZ noted that during the period under review, total loans and advances decreased by 0,26 percent from $3,82 billion as at March 31, 2014 to $3,81 billion as at June 30, 2014.

The banking sector however remained adequately capitalised during the period ended June 30, 2014, with the average capital adequacy ratio above the required minimum regulatory capital adequacy ratio of 12 percent.

“The increase in Capital Adequacy Ratio (CAR), over the quarter, was attributable to the decline in risk weighted assets (sector loans and advances) relative to capitalisation levels,” explained the RBZ. Credit risk however remains high.

The average ratio of non-performing loans to total loans increased to 18,49 percent as at June 30, 2014, up from 16,96 percent as at March 31, 2014. But the International Monetary Fund team, which was in the country last month, commended the Zimbabwean authorities for putting in place measures to stabilise the sector.

“The approval of the draft operational framework for the acquisition of non-performing loans by the Zimbabwe Asset Management Company and other private asset management companies by the RBZ Executive Committee/Board, submission to Parliament of amendments to the Reserve Bank of Zimbabwe Act, and amendments to the Banking Act, will be instrumental in restoring confidence and bringing stability to the sector,” said the IMF in its Staff Monitored Programme concluding remarks on September 29.

Meanwhile, the RBZ statistics also show that only a few banks are actually dominating the sector.

For instance, during the period under review six banks had loans and advances amounting to $2,35 billion, which accounted for 61,67 percent of total banking sector loans and advances as at June 30, 2014.

The problem has however remained that the local banks are funding consumption and not production.

Said the RBZ: “Banking sector lending was largely for consumptive purposes at the expense of the key productive sectors, with the individuals or household sector constituting 24,7 percent of total credit. Construction and mining sectors constituted 3,80 percent and 4,2 percent of total banking sector credit, respectively.” – BH24.

Comments