Bindura Nickel Corporation granted prescribed asset status

FINANCE and Economic Development Minister Patrick Chinamasa has granted Mwana Africa owned Bindura Nickel Corporation (BNC) subsidiary a prescribed asset (PA) status, allowing the firm to seek funding through the marketing of a fixed-term bond to help fund the restart of its Bindura smelter.

“The bond has been accorded PA status, meaning that Zimbabwean asset managers are required to invest a certain minimum percentage of their assets under management into prescribed assets. We will provide further details on the bond in due course,” Mwana pointed out in a statement on Friday.

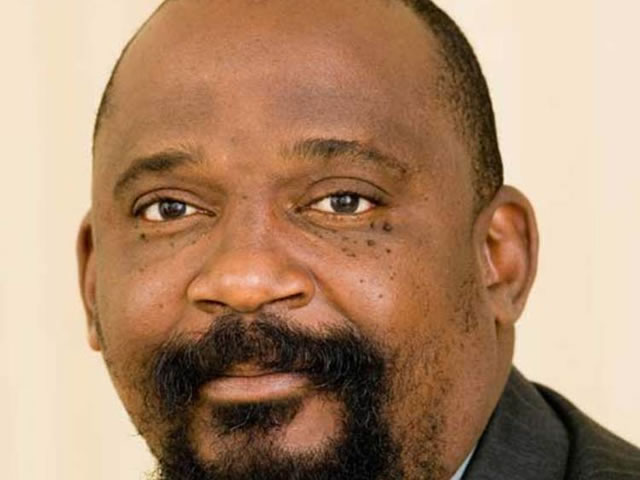

CEO Kalaa Mpinga commented that being awarded PA status not only provided additional financial support, but was also proof that Mwana’s continued contribution in Zimbabwe was being recognised.

“The rationale for restarting the smelter is the higher payability of nickel in leach alloy compared to nickel in concentrate. The restart is anticipated to increase revenue per tonne of contained nickel by between 15 percent and 20 percent as nickel in leach alloy is free from impurities such as magnesium oxide and therefore does not attract price penalties.

“Further, leach alloy transport requires 70 percent fewer trucks compared to transporting nickel concentrate and, therefore, the smelter restart will significantly cut operating costs,” he added.

Mwana revealed in June that the smelter would likely resume operations in the first half of 2015. The estimated overall capital cost to restart the smelter was $26.5 million, with BNC expecting to fund half of the cost through debt finance and the balance from its cash flow and Mwana’s cash-on-hand.

At the time, Mwana noted that the installed power for the furnace was 14 MW, with concentrate output expected to be about 160,000 t/y.

Given that concentrate production from the company’s Trojan mine, also in Zimbabwe, was expected to be about 106,677 wet metric tonnes a year, the smelter would have spare capacity to treat third-party material. – Miningweekly.

Comments