Indebted farmers seek Zamco bailout

Oliver Kazunga, Senior Business Reporter

THE Zimbabwe Commercial Farmers’ Union (ZCFU) is seeking the takeover, by the Zimbabwe Asset Management Company (Zamco), of non-performing loans from burdened farmers.

The asset management company, which started operating last year, was established by the Reserve Bank of Zimbabwe in 2014 to buy outNon-Performing Loans (NPLs) from commercial banks their collaterised loan book.

According to the asset management firm it had acquired $528 million of the $750 million in the banking sector as of June 30, 2016.

A majority of the NPLs so far absorbed by Zamco are from the manufacturing sector.

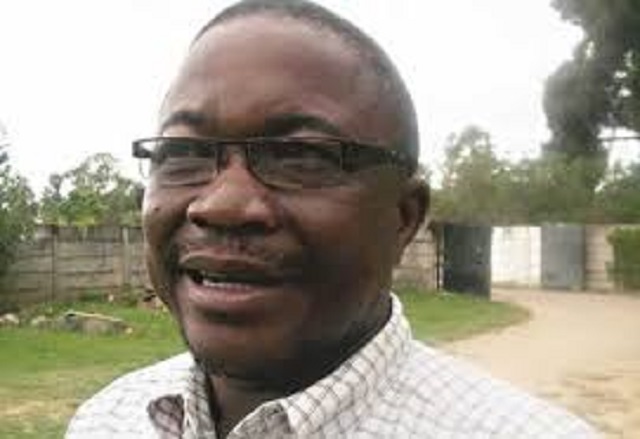

In an interview, ZCFU president Mr Wonder Chabikwa accused the banking sector of not showing commitment to forward the farmers’ NPLs to Zamco.

He said this was despite ZCFU having lobbied for the transfer of farmers’ NPLs to the asset management firm.

“It’s very unfortunate that banks have not forwarded the farmers’ NPLs to Zamco. We’ve in the past engaged the banks to have NPLs by farmers be taken over by Zamco so that the farmers have a fresh start for credit lines,” he said.

Mr Chabikwa said farming as an industry was presently choked with NPLs adding that the loans were borrowed from financial institutions between 2009 and 2012 and banks have started taking legal action against the farmers for failing to service the funds borrowed.

“Being a primary industry, it means if the farmers remain overburdened by NPLs, we’ll not be able to produce effectively even if the country receives adequate rains in the upcoming farming seasons.

“If agricultural output is low, it also means that companies across all the value chains in the agriculture sector will be negatively affected in terms of their manufacturing capacity,” he said.

Among other reasons, he said, farmers were failing to pay for the loans due to poor agricultural seasons the country has experienced in the previous years as well as high interest rates banks charged on the borrowers.

“Most of our members accessed the loans between 2009 and 2012 after surrendering collateral security mostly in the form of title deeds for houses.

“And because the loans were accessed at interest rates as high as 35 percent per annum the farmers are failing to pay and the situation has been worsened by excessive droughts the country has experienced over the years,” he said.

Zamco chief executive officer Dr Cosmas Kanhai has said his organisation would have mopped up all the NPLs in the banking sector by the end of the year.

The asset management firm is buying out NPLs with a focus to clean up the financial services’ sector balance sheets so that the institutions can confidently trade and lend.

The Government has said that Zamco would not buy out loans that were recklessly issued without due diligence and following good corporate governance procedures.

It is hoped that once the acquisition of NPLs is completed various resolution methods to address the problems emanating from NPLs will be implemented.

@okazunga

Comments