Zim passes IMF benchmark targets

Harare Bureau

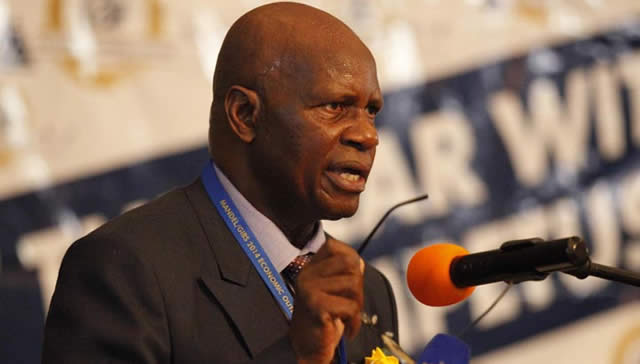

ZIMBABWE has met all the quantitative targets and structural benchmarks under the International Monetary Fund (IMF)’s staff monitored programme, the global financer said after its latest review exercise of the staff monitored programme.Addressing a joint press briefing with Finance and Economic Development Minister Patrick Chinamasa in Harare yesterday, IMF head of mission to Zimbabwe Domenico Fanizza said the country redoubled efforts on economic reforms to create an environment conducive for private sector investment.

“Zimbabwe met all the required targets that we set for the end-June review period. We strongly believe that Zimbabwe’s decision to re-engage international financial institutions will go a long way in instilling confidence within the country’s economy,” said Fanizza.

“This is a great step towards the proposed debt rescheduling.”

Nonetheless economic conditions remain difficult.

The IMF representative said economic growth had slowed down because of inadequate financial flows despite a very favourable agricultural season.

He said this and the appreciation of the South African rand, the major currency of Zimbabwe’s trading partner caused a liquidity crunch that weakened economy.

Fanizza said the government had taken decisive fiscal measures on the revenue and expenditure sides to keep fiscal policy on track and to protect social expenditures, despite the large civil service wage increase earlier on this year.

“It’s encouraging that the authorities have come to the conclusion that Zimbabwe cannot address these challenges without the support of the international financial community,” he said.

Minister Chinamasa said that Zimbabwe was prepared to work with IMF to normalise relations with all creditors and secure solutions to its debt overhang.

“I’m pleased to report that Zimbabwe met all the quantitative targets and structural benchmarks under our SMP with IMF for the period to 30 June 2014,” said Minister Chinamasa.

Quantitative targets under the SMP included budget balance for central government, expenditure on social sectors, building international reserves, ceiling on government guaranteed non-concessional debt of over one year tenure.

The structural benchmarks covered legislative reforms, including amendments to the Mines and Minerals Act, public debt management as well as reforms to the banking and reserve bank Acts.

Minister Chinamasa said after the successful implementation of the SMP, the government was now finalising negotiations for the successor SMP programme scheduled to run for a period of 15 months, from October 2014 to December 2015.

“The successor SMP provides for a coherent macro-economic framework that supports our effort to promote inclusive growth in line with the thrust of Zim-Asset,” he said.

Objectives of the new programme include consolidating the fiscal position, improving external position, restoring confidence in the banking sector, mobilising support for external debt, and reforming business climate, boosting productivity, competitiveness and building confidence.

Minister Chinamasa said the government had made its proposals for the quantitative targets and structural benchmarks under the successor SMP.

He said the government was committed to the implementation of the reform agenda and policies under the successor SMP to expedite reengagement with creditors, critical for debt resolution.

Consistent with Zim-Asset, the government will, create fiscal space for more resources to infrastructure, education, health and other critical social services to be funded from ring-fenced budget allocations to protect the vulnerable.

Further, through the 2015 National Budget, the government will create more fiscal space to cover budget demands arising from unforeseen developments.

The government will also create a culture of respecting contracts and paying all its debts.

Borrowings will be targeted at projects that generate inflows from which the debts would be paid.

Reforms would also be undertaken in tax policy and administration and national debt management.

Other reforms will include establishment by the Reserve Bank of a national credit bureau and recapitalisation of the central bank to improve its supervisory role and instill confidence in the banking sector.

Comments