10 000 fall prey to ponzi schemes

Harare Bureau

AT LEAST 10 000 people who fell prey to fly-by-night pyramid schemes within the last year have filed police reports across the country after being swindled of over US$30 million by scammers, who snatched the cash and skipped the border.

Gullibility has seen families selling houses, vehicles and other properties to invest in pyramid schemes, an old trick used by scammers as far back as the 1920s.

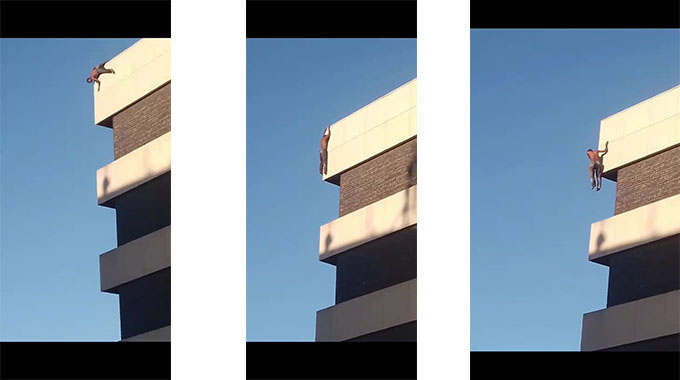

Some marriages collapsed after the scammers vanished with the money, while others have ended up committing suicide since mid-last year.

In some cases, family ties broke down because people invested using funds that were sent from relatives in the Diaspora for other needs.

A pyramid scheme is an illegal and fraudulent investment based on a hierarchical set of network marketing.

New recruits make up the base of the pyramid and provide the funding for so-called returns to the earlier investors or recruits structured above them in the scheme.

A pyramid collapses once the entity running the scheme is unable to sustain itself by failing to attract enough new investors to pay off earlier investors.

In fact the collapse is automatic since the schemes require a growing number of new recruits at each level, usually a significant multiple of the number in the previous level.

While in theory the scheme can continue until the next level requires more people than live on the planet, all obviously collapse long before that point is reached.

Once a pyramid scheme becomes popular, they attract the attention of regulatory authorities such as the Reserve Bank of Zimbabwe, which regulates deposit takers, and investigations are opened.

Since they are normally not registered under the laws of the country, the founders abruptly shut down business and disappear to other countries with investors’ money.

National police spokesperson Assistant Commissioner Paul Nyathi said police have since last year handled 892 cases across the country that involve pyramid schemes.

“At least 10 000 complainants reportedly lost over US$30 million between them. We have handled some 892 such cases involving thousands of complainants. The scammers quickly disappear after swindling the unsuspecting investors.

“Millions of dollars were lost, some lost houses while others committed suicide upon discovering they would have been duped. We have handled suicide cases related to Ponzi schemes,” Asst Comm Nyathi said.

He warned people against such schemes.

“As police, we urge people to desist from such dubious investments. Ponzi schemes start with lucrative interest rates but at the end the investors will lose. People must not be that gullible and they should shun such illegal schemes,” he said.

Comments