Industry raises concern over blended inflation model

Nqobile Bhebhe, Senior Business Reporter

CAPTAINS of industry have expressed reservations over the switch to the blended inflation rate for all official purposes saying the new thrust poses several transactional challenges for both consumers and businesses.

Zimbabwe now measures inflation using a weighted average of items priced in Zimbabwean dollars and US dollars (blended inflation). Before that, the official rate was based only on items in local currency.

The new development was given legal force in Statutory Instrument 27 Census and Statistic (General) Notice 2023 recently gazetted by Minister of Finance and Economic Development, Professor Mthuli Ncube.

Minister Mthuli Ncube

The notice first defines the “rate of inflation” as “the general increase in price levels of goods and services measured as a weighted average based on the use of Zimbabwean dollars and United States dollars over a given period of time”.

In its explanatory note on the release of last month’s inflation rates, the Zimbabwe National Statistics Agency (Zimstat) said that it records the prices of a wide range of items each month in both Zimbabwe dollars and US dollars.

ZimStat

The Reserve Bank of Zimbabwe in the 2023 Monetary Policy Statement recommended the switch to the currency-weighted consumer price index, indicating that blended inflation rates give a more accurate picture of just what is happening in the real Zimbabwean economy than reliance on a single currency rate, either US dollars or Zimbabwe dollars, would otherwise produce. However, in its February inflation and currency update, the largest industry lobby group, the Confederation of Zimbabwe Industries (CZI), said the dual currency nature of the economy means that the country needs two inflation rates.

“An inflation rate is only useful if it refers to the currency in use. There are a number of challenges that are going to emanate from the ban for both consumers and business because the blended inflation rate is not of much use in collective bargaining,” said the industry body.

“For example, the month-on-month blended inflation rate for February is reported as -1.6 percent. This effectively means that the spending power of workers is actually increasing on a month-on-month basis and there is no need for any salary raise.

“To a worker earning in ZWL$, this would be an incorrect conclusion, as prices have actually been rising between January and February.”

The lobby group said the blended inflation rate is off the mark in reflecting the actual developments on the ground. CZI noted that households receive their income in local currency or US dollar or a combination of both.

“They need to know whether to keep their ZWL$ income or to consume all of it to preserve value or even convert into USD. However, currently, they do not have any way of knowing the ZWL$ inflation for February and thus can’t make informed decisions with their ZWL$ income.”

In line with the dual currency nature, interest rates are different depending on whether one borrows in US dollar or local currency.

“For ZWL$, the interest rate is currently 150 percent. However, a firm without any idea about the ZWL$ inflation is not in any position to make a decision to borrow in ZWL$, as there is no way of working out the real interest rates,” it noted.

“Investors would generally require a consistent trend analysis to be able to have an idea as to the movement of inflation in an economy that they wish to invest in.

“The decision to stop the publication of a series of data simply means that there is now a break in data availability, which would make it difficult for investment decisions to be made without a misallocation of risk analysis.”

However, monetary authorities have indicated that there would be no switch to using a new inflation gauge to determine interest rates, despite the statistics agency having adopted it as its main price reference.

In February, the central bank cut its benchmark interest rate to 150 percent from 200 percent on expectations that a downward trend in inflation will continue.

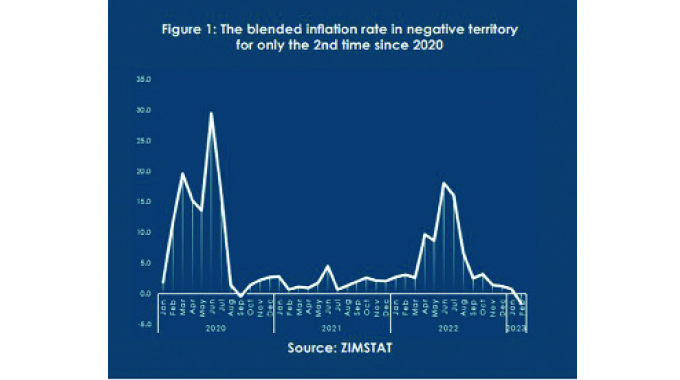

The annual blended inflation rate in February fell to double digits for the first time since July last year, and monthly price growth was -1,6 percent, the first negative reading since September 2020.

Comments