Banks making a killing through service charges

Prosper Ndlovu, Business Editor

BANKS in Zimbabwe are generating up to 90 percent of their revenue through service charges as opposed to the global norm of riding on interest rates.

Despite prevailing economic challenges, all banking institutions in the country have remained profitable with aggregate profit of $13.46 billion having been recorded for the half year ended 30 June 2020 alone, up from $79.40 million for the corresponding period in 2019, according to the Reserve Bank of Zimbabwe (RBZ). The key revenue drivers were mainly non-interest income.

Under normal circumstances, banks should receive interest on the loans offered to clients with profits being derived from the spread between the rate they pay for the deposits and the rate they earn or receive from borrowers, experts say. The expectation is also that banks must earn interest income from investing their cash in short-term securities like treasury bills, Government bonds and money markets.

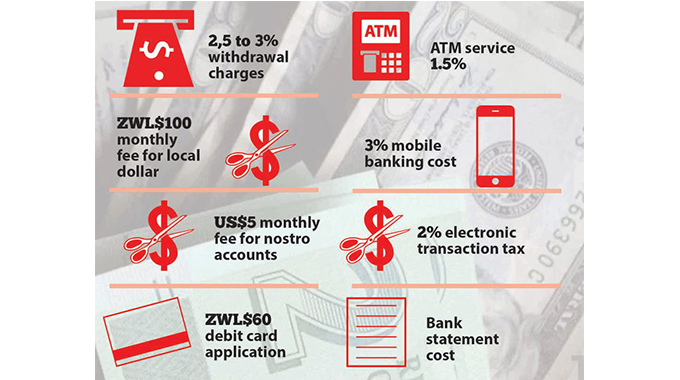

However, the situation is different in the country where banks have resorted periodically increasing service charges, which has raised the ire of depositors and is partly blamed for frustrating public confidence in using formal banking channels. For instance, banks levy between 2,5 percent and three percent for withdrawal charges with up to $100 monthly account fee for local dollar and US$5 for nostro accounts. It costs about $60 or so dollars to apply for a debit card while ATM transactions drain up to 1.5 percent charge with mobile banking going to three percent, plus the two percent electronic transaction tax.

Given the prevailing cash shortages in the economy, depositors have no choice but to use electronic transactions such as swipe, mobile money and bank transfers.

“It’s true that if we check the financials for our banks, a majority of them, 80 to 90 percent of their revenue is actually coming from bank charges, it is not a good sign,” said Deputy Minister of Finance and Economic Development, Clemence Chiduwa. He was responding to questions from legislators in Parliament last week. This was after Umzingwane legislator, Levy Mayihlome, had accused the banks of manipulating the poor to maximise income through service charges that erode the little income from a majority of depositors.

“The banking sector in this country is earning income from bank charges instead of interest rates. What is the Ministry of Finance and Economic Development doing to change that culture so that banks earn from lending to clients instead of arm-twisting poor citizens who send their money to the bank and they have no choice,” said Mayihlome.

“They are charging these bank charges without their consent. What is the ministry doing to change that mindset?”

Bulawayo East legislator, Ilos Nyoni, weighed in saying the Government, through the Reserve Bank of Zimbabwe, should rein in on banks and protect the poor.

“Why are you not encouraging banks to review their charges to favourable amounts just like what we do when we pay taxes such as duty, PAYE and so forth?” he asked.

“If you have got cash, it discourages you from using the bank card to pay an interbank transfer.”

Deputy Minister Chiduwa, however, said the prevailing inflationary macro-economic environment has not been good for banks to be able to lend and thereby do normal business. Because of the issue of being risk averse, he said most banks have not been active on lending hence the greater part of their revenue was now coming from financial charges. Financial experts share the same view.

“The fact that very little is earned from interest income tells us that lending is totally paralysed and possibly in comatose”.

There is so much volatility ranging from episodic hyperinflation to oppressive exchange rates. Lack of confidence in the currency also exacerbates the problem. Consequently, given the exorbitant interest rates, there are also very minimal borrowers,” said financial economist, Mr Collet Ndlovu.

Being aware of the public outcry over bank charges, Dep Min Chiduwa said the Government engaged in talks with the Bankers Association of Zimbabwe to resolve the matter. He hoped that since the country was shifting towards a period of financial stability following the introduction of the foreign currency auction trading system, going forward banks would be expected to revert to their original function.

“This is where we are now and we are engaging the stakeholders through the RBZ and the Bankers Association of Zimbabwe. In terms of our interface with the banks, we do encourage the banks to keep the transaction charges at minimum,” said the Deputy Minister.

He also clarified that in terms of the procedure, before a bank can increase its charges, it should seek authority from the RBZ, which would give guidance without necessarily providing a limit on the charges.

“So, in terms of our situation here, the justification that is being given by the banks is the backend platform that they are using to run their system is imported. So, as long as there is currency volatility, they are bound to increase the charges.”

Comments