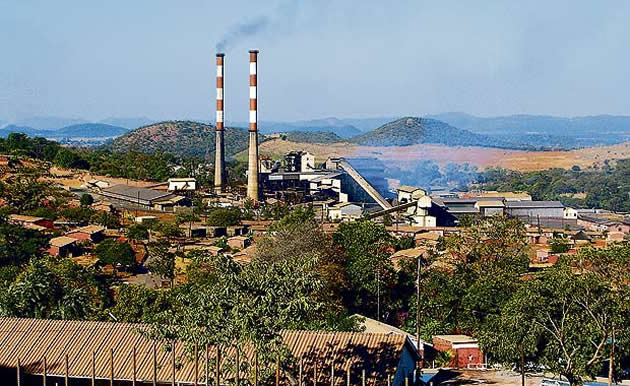

Bindura Nickel Corp in the red

Senior Business Reporter

BINDURA Nickel Corporation (BNC) is in the red after the group’s current liabilities exceeded current assets by $4,7 million according to the financial report for the year ended March 31, 2018.

The nickel miner’s current liabilities amounts to $32,7 million compared to current assets totalling $28 million. In a statement accompanying the group’s financial results for the period under review, BNC chairman Mr Muchadeyi Masunda said while his organisation earned a profit before taxation amounting to $7,9 million, the company’s going status was a cause for concern.

“The group’s current liabilities exceeded its current assets by $4,7 million. Consequently, the group’s ability to continue as a going concern is dependent on its ability to generate positive cash flows,” he said.

“These conditions give rise to a material uncertainty, which may cast significant doubt about the group’s ability to continue as a going concern and, therefore, it may be unable to realise its assets and discharge its liabilities in the normal course of business.”

The group posted an 857 percent increase in profit after-tax amounting $5,8 million during the financial year under review. Mr Masunda, however, said as at March 31, 2018, the group’s net cash position was on overdraft of $2,7 million and fully utilised overdraft facility of $7 million.

In addition, the group had an asset financing facility of $5 million from which only $2 million had been utilised as at the reporting date.

“The asset facility of $5 million had a tenor of three years with a 12 months moratorium. The $7 million overdraft facility expired in May 2018 and was successfully renewed by another 12 months to May 2019,” he said, adding that “the directors were confident that the facility would be rolled over again or replaced as the group has managed to achieve this”.

During the period under review BNC has not declared a dividend and has suspended plans to complete its smelter facility restart programme.

Meanwhile, total capital expenditure for the year was $4,6 million.

“The Trojan Shaft Re-deepening Project will see the deepening of the Trojan Mine Shaft to Level 46. Total approved capital expenditure is $18,9 million, of which $14,3 million has been spent since the project’s inception,” said Mr Masunda.

He said the smelter restart project at Bindura was 83 percent complete and had been suspended during the year under review due to funding constraints.

In the financial year to March 31, 2018, BNC produced 6 620 tonnes of nickel compared to 6 762 tonnes in the prior period.

A total of 6 470 tonnes in nickel concentrates were sold compared to 6705 tonnes in the previous year. The group’s turnover improved to $18,8 million from $14 million on the back of better prices of the commodity on the international market.

Comments