‘Dual currency serving the country well’

Prosper Ndlovu, Business Editor

RESERVE Bank Governor, Dr John Mangudya, has said the partial dollarisation approach is serving a good economic purpose as a transitional measure but urged market players to focus on the long-term, which is de-dollarisation.

While the Government has entrenched the use of foreign currency as an official medium of exchange along side the local dollar, at least up to 2025, it has clarified that the ultimate was full return of Zim-dollar.

Despite relative macro-economic stability typified by a recent halt in exchange rate and inflation volatility, economic players have stressed the need for authorities to do more to counter negative expectations emanating from the memory of past inflation.

During last week’s economic conference in Victoria Falls, industry leaders, with concurrence from academic researchers stated that the negative expectations were responsible for the overshooting of the parallel exchange rate in the short-term.

They also raised concern over Government services such as passports and import duty, among others, which are charged in US-dollar when most wages in public and private sector are paid in local currency.

Others felt that delays in disbursement of forex from the auction were disrupting business operations and that Government bulk payments to suppliers of goods and services are off-loaded on parallel market for conversion to US dollar for value preservation.

In a detailed response to the above concerns, Dr Mangudya said the country’s economic outlook remains strong as the requisite economic and financial fundamentals for stability are present.

He assured stakeholders that past drivers of exchange rate volatility have been correctly identified and are being aggressively dealt with.

“The dual currency system is serving the country well and needs to be sustained as a transitional arrangement to de-dollarisation, which itself is a medium to long term agenda, that is, it takes three to five years to attain,” said the Governor.

“Let’s continue to focus on enhancing the efficacy of partial dollarisation as opposed to changing the currency system. Let’s give the current measures a chance to take effect and assess their implications on price and exchange rate stability.”

In its Mid-term Monetary Policy statement, the Apex Bank has put in place additional measures to sustain the prevailing stability momentum.

These include maintained tight monetary policy stance with bank policy rate at 200 percent, which will be reviewed in line with inflation developments, differential statutory reserves extension to foreign currency deposits at 2,5 percent and five percent to support continued safety and soundness of the domestic banking sector, foreign exchange retention maintained at current levels with agricultural sector retaining 75 percent and the tourism sector at 100 percent.

Reserve Bank of Zimbabwe (RBZ)

The RBZ has also increased the willing-buyer willing-seller amount from US$10 000 to US$20 000 while Bureaux de change transactions have risen from US$500 per week to US$5 000 per transaction per month.

Further, the bank has proposed introduction of smaller units of gold coins of a tenth ounce, quarter ounce and half ounce to enhance inclusiveness of the investment instrument.

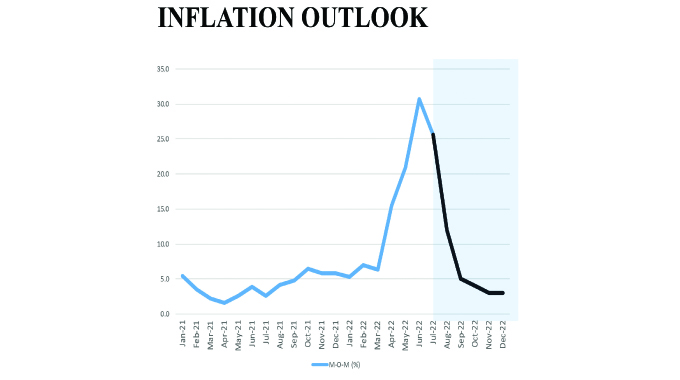

Based on these propositions, Dr Mangudya assured the market that the envisaged exchange rate stability “will anchor inflation expectations, thus reducing month-on-month inflation to below three percent by end of December this year.”

He stated that a fixed exchange rate arrangement in the form of currency board as suggested by some business leaders may not be suitable in the current environment saying the economy is likely to experience the same hard-peg challenges that prevailed under multi-currency system.

“Overvaluation, loss of competitiveness, need for full coverage of the monetary base with forex reserves, limited scope for adjustment to external shocks- internal devaluation through wages and prices, might lead to deflation,” said Dr Mangudya.

Riding on the restored macro-economic stability, Dr Mangudya said the parallel market exchange rate has already declined to between ZW$700 to ZW$ 750 from a peak of between ZW$800 and ZW$900.

Given tight money supply measures, enhanced flexibility on foreign currency trading and strong penalties on currency manipulators, he said the willing-buyer willing-seller rate was expected to converge with parallel market rate.

“In the outlook period the exchange rates are envisaged to converge between ZW$650 and ZW$ 680 by end of September 2022,” said Dr Mangudya.

He said the positive pass-through effects on consumers, which has already been seen through a slight drop in inflation and cost of living, based on official reports, will be buttressed by strong forex receipts.

“Total foreign currency receipts increased by 33,6 percent in the first half of 2022 while diaspora remittances rose by 23 percent,” said Dr Mangudya.

“Strong foreign currency receipts relative to foreign payments, coupled with monetary restraint should lead to favourable exchange rate dynamics.

“Convergence in exchange rates is expected to result in a progressive decline in month-on-month inflation.”

Comments