EDITORIAL COMMENT: Return of interbank forex trading positive

Local banks started trading in foreign currency yesterday, two days after the Reserve Bank of Zimbabwe (RBZ) liberalised the foreign exchange market.

Bureaux de change, basically non-existent since their banning in 2002, are expected to follow suit.

In the 2019 monetary policy statement he issued on Wednesday, RBZ Governor, Dr John Mangudya not only announced the unpegging of the 1-1 US$-bond exchange rate but also said the interbank foreign currency market would return with the financial institutions buying and selling the money on a willing buyer-willing seller basis. He said the Government had secured lines of credit to support the foreign exchange regime.

Earlier yesterday morning, Dr Mangudya had met representatives of banks and agreed to start at a rate of US$1 to $2,5 bond. The rate is however, substantially lower than the US$1 to $4 bond that is prevailing rate on the parallel illegal market. He, however, expects the rate to locate itself over time driven by market forces.

The central bank is optimistic, as we all are, that the epoch-making development of yesterday will bring sanity into the foreign currency market, promote exports, boost diaspora remittances and investments, eliminate multi-tier pricing, as well as preserve the value of local forms of money.

Partly as a result of the Government’s control of the foreign currency market and the fact that there is not much of the foreign money available in our country amid poor export performance and resulting low foreign currency receipts, effectively all of the trade in the money was done on the illegal parallel market where US$1 was buying much more than the legislated $1 bond. Rates have been fluctuating but they appeared to have stabilised on US$1-$3,5 bond in recent months.

It is great that the Government has been making all the right decisions, a departure from the old way of doing things whereby authorities appeared to want to remake the laws of economics.

Among the many sound decisions that the Government has made is the separation of nostro and bond accounts in October last year. People and companies that were generating foreign currency and receiving it through banks at 1-1 exchange were losing much of their money since the black market rate was about 1-3. The market welcomed that decision. As a result foreign currency inflows through the formal market have increased by 88 percent between October last year and last month.

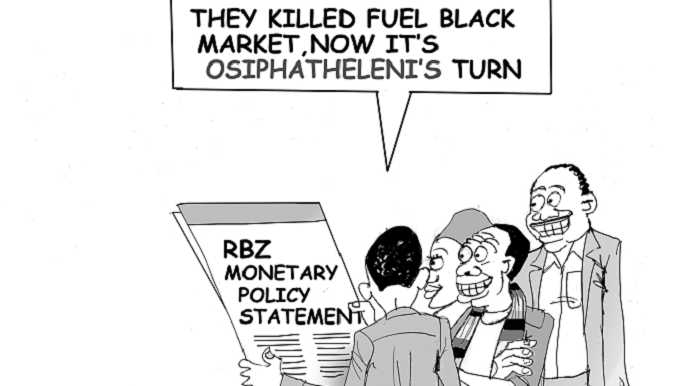

Another bold and sound decision that the Government has made is increasing the price of fuel three-fold when it became clear that a managed price of around $1,38 bond per litre was not in sync with the real cost of procurement of the commodity. It was a bold, correct decision that President Mnangagwa himself announced on January 12. The prices were set at $3,11 for a litre of diesel and $3,31 for petrol. It showed a realisation that the 1-1 exchange rate between the US$ and the bond was unrealistic at a time when one green back was buying about $3,3 bond.

In addition, the Government has succeeded in drastically cutting its expenditure. Resultantly, the State has been achieving surpluses consistently since October last year. In line with the austerity measures, the new MPs and Cabinet Ministers have not taken delivery of new cars; a departure from the old system when the Government spent millions on the vehicles immediately after a new Parliament and Cabinet took office. The President himself took a salary cut last month.

We take yesterday’s development as positive; one that will engender greater confidence in the economy.

We are glad that as Dr Mangudya said on Wednesday, the resumption of the interbank market was indeed with immediate effect.

A country where people and businesses are free to buy and sell foreign currency, among other assets, on the official market, without the fear of arrest or being conned when trading in a car somewhere around Tredgold Building inspires confidence in investors, whether they are local or foreign. In such an environment, foreign investors would be convinced that it would be easy for them to get dividend payments or repatriate profits into bank accounts held abroad.

We expect more Zimbabweans in the diaspora would be motivated to send more remittances back home more safely through banks. A liberalised foreign currency market will encourage Zimbabweans working abroad to send more of their money home knowing that the value of their money will be preserved.

Remittances contribute greatly to investment and foreign currency inflows, competing favourably with exports. We therefore, expect more of them to invest their resources back home, thus contributing to national economic recovery and growth.

It is normal that after many years of challenges, the market will need some time to see how new initiatives, including the interbank foreign currency market, perform. There is nothing wrong with that but we have no doubt that this policy is there to stay as the record of the Second Republic inspires confidence because of its consistency and predictability.

Comments