Gender gap: Zimbabwean men seek loans more than women

Nqobile Bhebhe, Senior Business Reporter

The Reserve Bank of Zimbabwe (RBZ) says males seek loans more than their female counterparts with the current ratio indicating that male borrowers constitute 68.31 percent while female borrowers account for 31.69 percent.

In the same vein, the central bank records also reveal that males dominate delinquent loans, as they fail to make their payments on time.

In his recent 2022 mid-term monetary policy statement released on Thursday, RBZ governor, Dr John Mangudya said the sustained availability and growth of the Credit Registry System continues to play a critical role in provision of credit and effective management and ongoing monitoring of credit in the sector.

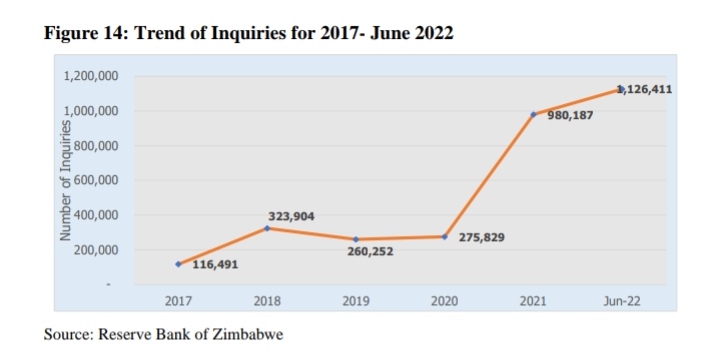

The Credit Registry System registered a total of 1,126,411 enquiries as at 30 June 2022, up from 980,187 as at 31 December 2021 reflecting increased usage as the adoption of the Credit Registry System improves over time.

The credit registry facility was operationalised in January 2017 to arrest an upsurge in non-performing loans.

Amendments to the Banking Act provided for the establishment of a credit registry so that banks are able to vet all borrowers for credit worthiness for purposes of managing bad loans.

“The Credit Registry had 541,488 active loan contracts as at 30 June 2022, with individuals’ records accounting for 97.93 percent of the records.

“Gender distribution of loans is generally skewed towards male borrowers who constituted 68.31 percent while female borrowers constituted 31.69 percent of loan contracts in the Credit Registry.”

On the ratio of delinquent loans, the apex bank governor said: “The Credit Registry database indicates that only 6.86 percent of total loans granted to female borrowers were delinquent compared to 7.27 percent for male borrowers”.

The Credit Registry database indicates that only 6.86% of total loans granted to female borrowers were delinquent compared to 7.27 % for male borrowers

Meanwhile, Dr Mangudya said the Credit Registry enquiries on the facility have surpassed one million mark reaching 1,1 million as at 30 June, 2022 up from 980,187 as at 31 December 2021 reflecting increased usage as the adoption of the Credit Registry System improves over time.

“The Credit Registry System registered a total of 1,126,411 enquiries as at 30 June 2022, up from 980,187 as at 31 December 2021 reflecting increased usage as the adoption of the Credit Registry System improves over time,” he said.

Since 2017, the inquiry trend has been on the upside from 116 491 reaching 275 252 in 2020 and rising sharply to 980 187 in 2021 and surpassing the one million mark by June this year.

He revealed that the Credit Registry has commenced engagements with microfinance institutions to bring them on board as data providers.

“It is anticipated that microfinance institutions’ data will further enrich and broaden the scope of the credit registry database.

This month, the central bank is targeting to conduct the final pilot testing of the Collateral Registry System.

The Collateral Registry system is expected to centralise the database of movable assets accepted by banks and MFIs as collateral for secured loans.

“The new system will facilitate access to credit and encourage economic activity and contribute towards stimulating growth to the various economic sectors,” said the governor.

Comments