IMF showers praises on Zim

Business Editor

THE International Monetary Fund (IMF) has lauded Zimbabwe’s resilience to Covid-19 while endorsing the significant progress made by the Second Republic led by President Mnangagwa towards transforming the economy.

The country is poised for solid economic recovery across key sectors this year, riding on the bumper harvest realised in the last season, said the IMF in a statement Wednesday following the conclusion of its virtual staff visit to Zimbabwe.

“Zimbabwe has shown resilience in the face of the Covid-19 pandemic and other exogenous shocks. The pandemic, on top of Cyclone Idai in 2019, a protracted drought, and weak policy buffers, has taken a severe toll on the economic and humanitarian situation,” said IMF.

“However, an economic recovery is under way in 2021, with real GDP expected to grow by about six percent, reflecting a bumper agricultural output, increased energy production, and the resumption of greater manufacturing and construction activities.”

The World Bank has also projected good times for the country, buttressing Treasury’s estimates that the economy could jump by a margin of up to seven percent.

The IMF staff team led by Mr Dhaneshwar Ghura conducted a virtual staff visit with the Zimbabwe authorities between June 1 to 15 to discuss recent economic developments and the economic outlook.

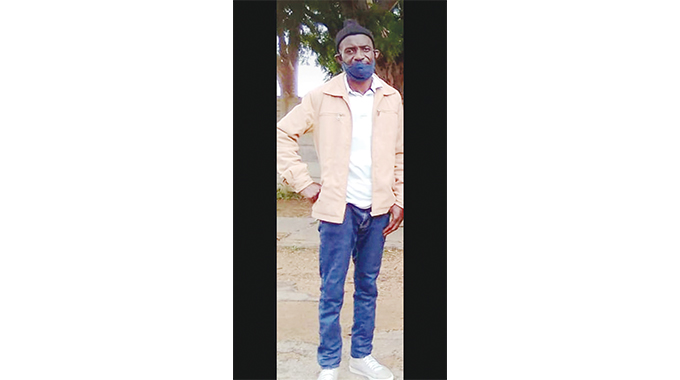

Mr Dhaneshwar Ghura

The team meetings with Finance and Economic Development Minister, Professor Mthuli Ncube Reserve Bank of Zimbabwe Governor, Dr John Mangudya, other senior Government, representatives of the private sector and Zimbabwe’s development partners.

In its statement at the conclusion of the virtual mission, the IMF noted that Covid-19 had adverse impact on businesses and vulnerable groups despite timely actions by the Government. This saw real GDP contracting by four percent in 2020, after a six percent decline in 2019.

It, however, said the outlook was dependent on the pandemic’s evolution, the pace of vaccination and sustainable policy implementation.

“The IMF mission notes the authorities’ efforts to stabilise the local currency and lower inflation. In this regard, contained budget deficits and reserve money growth, as well as the introduction of a foreign exchange auction system, are policy measures in the right direction,” it said.

“Further efforts are needed to solidify the stabilisation trends and accelerate reforms. The near-term macro-economic imperative is to improve the co-ordination among fiscal, foreign exchange and monetary policies, while addressing Covid-19 related economic and humanitarian challenges.”

The need for continued structural reforms aimed at improving the business climate and reducing governance vulnerabilities are essential for ensuring sustained and inclusive growth.

“To this end, the authorities’ strategy and policies as embodied in their National Development Strategy need to be fully operationalised and implemented,” said IMF.

“Durable macro-economic stability and structural reforms would bode well for the recovery and Zimbabwe’s development objectives.”

Meanwhile, IMF said Zimbabwe was a fund member in good standing after it cleared its outstanding arrears to the IMF in late 2016.

However, the country is being hindered from financial support “due to an unsustainable debt and official external arrears”.

Zimbabwe still owes billions of dollars to the international lenders such as the World Bank, African Development Bank and European Investment Bank.

“A fund financial arrangement would require a clear path to comprehensive restructuring of Zimbabwe’s external debt, including the clearance of arrears and obtaining financing assurances from official creditors, a reform plan that is consistent with macro-economic stability, growth and poverty reduction, a reinforcement of the social safety net and governance and transparency reforms,” said the multilateral lender.

“The virtual IMF mission staff visit outcome will serve as a key input in the preparations for the 2021 Article IV consultation mission expected to take place later this year.”

Comments