Labour market changes freeze 477 pension funds

Prosper Ndlovu, Business Editor

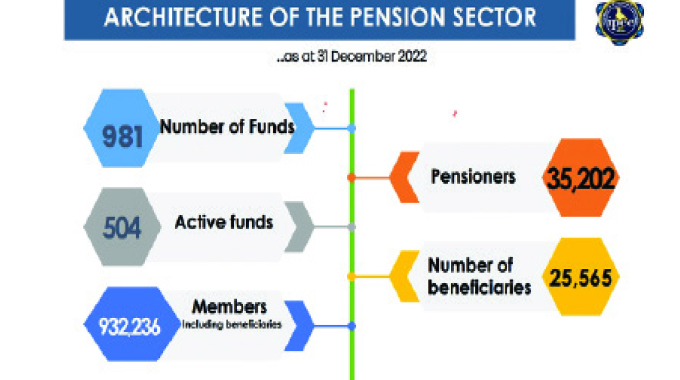

A COMBINATION of labour market changes including migration and closure of some companies in recent years have trimmed down the number of active pension funds in Zimbabwe to 504 from 981 as at December 31, 2022.

According to the Insurance and Pensions Commission (Ipec), the country has 981 pension funds of which only 504 were active as of December last year, which means 477 pension funds are now defunct.

A pension is a retirement plan or form of insurance against old age poverty or loss of income after retirement.

Industry experts say the decline in the number of active pension funds strongly reflects the structural transformation of the economy, which is now dominated by the informal sector, a majority of whose players do not have either pension or insurance cover.

Statistics from the National Social Security Authority (Nssa) already shows that a majority of people are excluded from social security cover as only 24 percent of the working population is covered by various schemes offered by the organisation.

National Security Authority (Nssa)

Dr Grace Muradzikwa, the Ipec commissioner, told journalists during a recent virtual media mentorship programme, that the pensions sector has 35 202 pensioners with 932 236 members including beneficiaries.

IPEC Commissioner, Dr Grace Muradzikwa

In explaining the trend, head of pensions directorate at Ipec, Mr Cuthbert Munjoma, said the higher number of inactive pension funds is largely due to changes in the labour market.

“Generally, the employment levels are changing. Since the peak of the economy in 1990s, we have seen companies closing, we have witnessed the migration from Zimbabwe to other countries, so that has had a bearing on the status of the number of pension funds that are active,” he said.

Mr Cuthbert Munjoma

“The moment the sponsoring employer closes, that pension fund will be considered inactive because it would cease to receive contributions. So, what will happen is that it will be granted what we call a ‘paid-up status’.

“So, they will apply to us to say we no longer have a sponsoring employer, what we now just want is to have those assets invested as people wait for their retirement. So that’s one of the major reasons, company closures.”

On the other hand, Mr Munjoma said the Commission has also witnessed that partly because of confidence issues linked to legacy concerns of loss of value of savings in the past years, some employers have opted to discontinue certain pension schemes.

“The employer will still be there but they decide that given the voluntary nature of the private occupational schemes that they are no longer interested to continue contributing,” he said.

“They can apply for paid-up status or apply for dissolution. So, essentially those are the main reasons why there are inactive funds.”

Commenting on the issue, seasoned labour matters expert, Mr Davies Ndumiso Sibanda, said due to the economic challenges the country has gone through, some employers were struggling to meet pension fund contributions hence the number of inactive funds.

He said often business organisations prioritise pooling resources together to pay workers’ salaries and sustain operations followed by raising funds to pay statutory obligations such as taxes to Zimra, Nssa contributions and NECs.

“These statutory bodies can garnish but pension funds have no teeth to bite. So, payment of pension funds come last and some businesses only remit funds for workers who are leaving or those who have left,” said Mr Sibanda.

“This arrangement is detrimental to the whole pension fund as it affects investment of those funds for future benefit.”

Mr Sibanda said reality on the ground shows that legacy issues linked to value preservation concern and losses suffered in pension savings from the switch to foreign currency in 2009, as well as losses incurred in 2019 following policy changes, have frustrated workers’ confidence in pension fund schemes.

“This means employees need to do a proper retirement planning and employers also need to assist their workers to better prepare for retirement,” he said.

Meanwhile, the pensions sector assets were valued at ZW$1,11 trillion of which the local dollar accounted for ZW$977 billion with the foreign currency component accounting for US$193 million.

Comments