Low to middle-income housing project takes off from Bulawayo

Nqobile Bhebhe, Senior Business Reporter

BULAWAYO yesterday witnessed the official launch of a US$11 million housing project that will result in the construction of thousands of low-cost housing units in selected parts of the country with the City of Kings being the launchpad.

The project is being developed by financial services institution BancABC from the US$11 million funding availed by Shelter Afrique and is targeting the construction of houses for low to middle-income earners countrywide.

It will benefit home seekers from Bulawayo, Harare, Gweru, Masvingo and Mutare.

Shelter Afrique is a Pan-African banking institution that exclusively supports the development of affordable housing and real estate sector development in Africa.

African Development Bank

It is in partnership with at least 44 African governments, the African Development Bank and the Africa Reinsurance Corporation — set up to mobilise funds to build homes.

The facility has already extended a US$25 million lines of credit to Zimbabwe’s private sector housing programmes through three Zimbabwean institutions to build 5 000 low-cost houses in line with the National Development Strategy 1.

Of the total lines of credit, BancABC gets US$11 million, National Building Society (NBS) US$4 million while the Urban Development Corporation (UDCorp) got US$10 million.

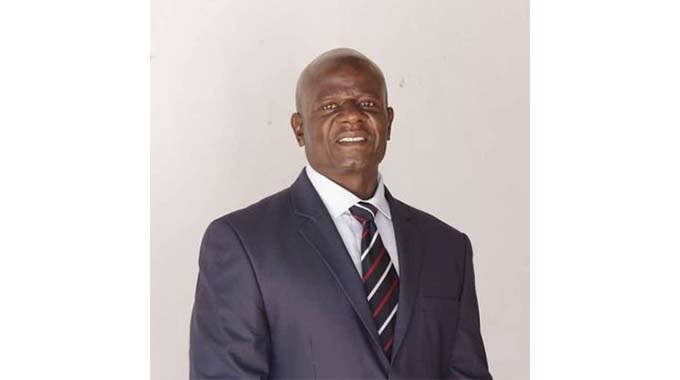

The Minister of Housing and Social Amenities, Daniel Garwe, presided over the launch at Hopelyn Housing Estate next to Bulawayo’s Mahatshula suburb where he unveiled close to 90 fully serviced stands.

The project comes at a time when the city is battling to reduce the housing waiting list and such private sector input goes a long way in easing rising ease demand for shelter.

Daniel Garwe

In his main address, Minister Garwe applauded the involvement of banks and other private sector players in housing construction saying the project aligns with the short, medium and long-term plan by the Government to attain decent housing for all in line with Vision 2030.

He said the participation of Shelter Afrique shows confidence in the country as a favourable investment destination.

The ultimate goal being to ensure high impact on community development and contributing to future investment through improved infrastructure, said Minister Garwe.

“The Government of Zimbabwe, through my ministry, is a shareholder in Shelter Afrique. Shelter Afrique is a Pan-African finance institution that exclusively supports the development of the housing and real estate sector in Africa,” he said.

“Zimbabwe has been a beneficiary of funding from Shelter Afrique over the years through the ministry and private sector players such as BancABC.

“As Government, we encourage other banks in Zimbabwe to emulate what BancABC is doing in housing delivery.”

In 2011, BancABC and Shelter Afrique extended loans valued at US$7 million for the construction of houses across the country.

BancABC

Another US$5 million was added in 2015 for the importation of building materials and equipment.

The purpose of the facility is for onward lending for mortgage origination supporting house construction, home extension and home improvement, funding housing projects for potential developers and financing small-scale commercial projects such as small shopping malls.

Minister Garwe said there were ongoing discussions for further partnerships with BancABC as such strategic deals were key to unlocking solutions to the housing shortages.

He said BancABC has a framework from recently completed property development projects where it has entered into joint venture agreements with developers and landowners.

In such instances, Government’s role will be to facilitate provision of land and supporting regulatory approvals while Shelter Afrique will be providing primary financing with BancABC directly funding the projects and facilitating the creation of a mortgage book.

Minister Garwe said it was pleasing to note that financial instructions were fast warming up to easing requirements for mortgage facilities.

Given that a majority of Zimbabweans are self-employed, the minister said terms such as requirement for pay slips should be reviewed.

Serviced stands in Mahatshula

He stated that most Zimbabweans are not defaulting on their monthly rentals and that is a good indicator that they would not default in servicing their mortgages.

As part of the National Development Strategy 1 in the housing cluster, the minister said by 2025, a total of 220 000 housing units would have been built countrywide to reduce the estimated 1,5 million housing backlog.

This goal will only be achieved through the use of modern building technology in housing delivery, which demands amendment of existing by-laws.

“Adoption of new building technology must be considered as we endeavour to fast-track delivery of housing and social amenities to our people. Cabinet made a deliberate decision to approve the adoption of new building technologies,” said Garwe.

“The model building by-laws need to be revisited in order to accommodate new technologies and allay any fears that would-be investors and inventors might be saddled with.”

As part of fulfilling the Zimbabwe National Human Settlement Policy, Minister Garwe said it is now mandatory that 40 percent of the land for housing projects is set aside for flats construction.

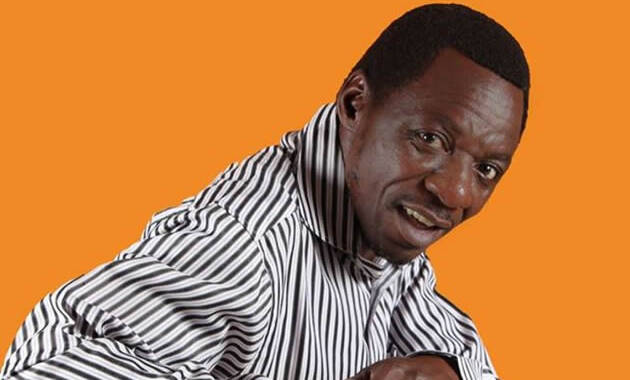

Dr Lance Mambondiyani

In his remarks BancABC chief executive, Dr Lance Mambondiyani, said the bank was working with the ministry to ensure that houses benefit low income earners and beneficiaries had been selected from the national housing waiting list.

“We are excited about the launch of the Hopelyn Housing Scheme, one of a few other housing schemes across the country,” he said.

“It’s not a coincidence that we came here first, it is our statement that this scheme will not be centralised to one city but for all cities to benefit.

“We have heeded the Government’s call to partner and invest in housing development projects in the country and together with our partners, we will pay our small part with more projects like these.”–@nqobilebhebhe

Comments