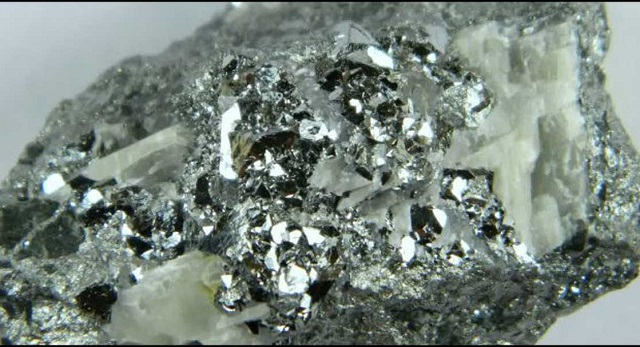

Nickel mine invests $19m on smelter plant

Oliver Kazunga, Senior Business Reporter

BINDURA Nickel Mine (BNC) has committed $19,5 million towards the restart of its smelter plant at Trojan Mine.

In 2014, BNC which is owned by ASA Resources group formerly Mwana Africa, a multi-commodity resource firm, successfully floated a $20 million bond issue to raise additional funding for the $26,5 million smelter restart project.

In a statement accompanying ASA Group’s unaudited financial results for the half year ended September 30, 2016, the firm said it hoped for improved business with prospects of giving the mine a longer lifespan.

“With the price outlook for nickel more encouraging and the smelter taking shape ($19.5m committed and 71 percent complete), management is revisiting phase II of the shaft re-deepening project. On completion, it would extend the life of mine by about five years and give Trojan increased access to known ore reserves and potentially higher grades in advance of the smelter restart,” it said.

It is hoped that the re-deepening project will provide increased feed for the smelter as well as allowing exploration drilling to continue to evaluate resources below 45/0 level.

“It will cost approximately $5 million to complete this project and extend the shaft system. Trojan’s concentrate can only provide sufficient output to meet 50-55 percent of the smelter’s total capacity and, without third party feed, it would not be running at optimum levels on present production,” said ASA.

To assist with bringing the two projects to fruition in 2017, the multi-commodity resource company said bond holders have agreed to place a 12-month moratorium on the principal bond debt while BNC will in the meantime continue making interest payments as normal.

“When the previous executive originally negotiated the $20m bond, in 2014, it was assumed nickel prices would be higher and this moratorium gives BNC time to complete the smelter project and, hopefully, for nickel prices to increase further.

“Trojan’s $1.2m after tax profit reflects the steady rise in the price of nickel and the impressive all-in sustaining costs of $5 759 per tonne for the half year,” it said.

Turning to gold production at Freda Rebecca Mine, the multi-commodity resource company said the challenges at Freda were different to those at BNC.

The performance at Freda has been very consistent over the years, but milling capacity has held them back.

“With the commissioning of two additional small mills, this problem will finally be resolved in the next few quarters. It remains our objective to have C3 costs below $1 000 ounces and reach gold output of 80 000 to 100 000 ounces per annum. It said there was a new mill plan to gradually reach the set targets.

“This plan includes repairing the cracked shield cap of our main mill and the refurbishment of both existing mills. This plan will be executed in the next six months and I am confident that, when the milling capacity of 1.8m tonnes is achieved, Freda Rebecca will be in a good position to contribute significantly to the group’s future prospects,” said ASA.

ASA Resources chief executive officer Mr Yat Hoi Ning commented that the first half of the year saw steady progress across the group with an after tax profit of $3.1 million, predominantly coming from its Freda Rebecca and BNC.

“While I am pleased with this progress, we must remain focused on reducing our corporate and operating costs further to reflect the contrasting movements in nickel and gold . . . the main objectives for the group for the second half of the year are consistency of output and C3 targets. The outflow of cash for the period was $6.3 million. It comprised cash generated by operations of $3.1 million, cash utilised in investing activities of $11.3 million and cash advanced through financing activities of $1.9 million,” he said.

@okazunga

Comments