Prices must fall. . . as fuel costs continue to drop

Patrick Chitumba and Nqobile Bhebhe, Business Reporters

BUSINESSES should progressively reduce prices of goods and services to ease the burden on consumers in line with the continued drop in fuel prices, which all along has been cited as a major cost driver, stakeholders have said.

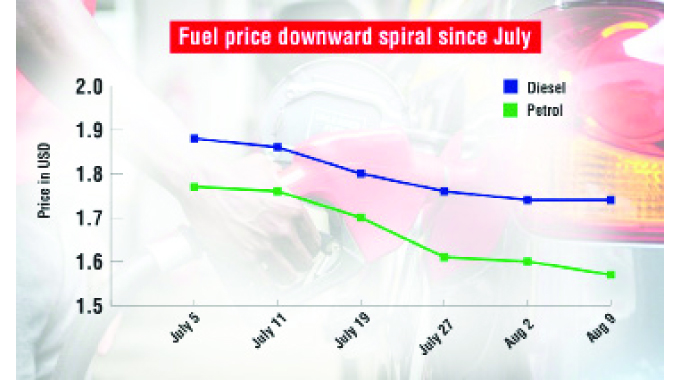

The steady decline in fuel costs since the beginning of July, coupled with corrective policy measures being implemented by the Government have been commended by economists for bringing about macro-economic stability and slowing down inflationary pressures.

However, consumers and workers are yet to feel the real impact of these positives on their pockets, as pricing of basic goods and services remains on the steep side.

Authorities have accused some businesses of sabotaging the economy through unjustified profiteering based on speculative sentiments that defy stable fundamentals.

THE Zimbabwe Energy Regulatory Authority (Zera)

According to the Zimbabwe Energy Regulatory Authority (Zera), the fuel pump price, for instance, has steadily dropped from a peak of US$1,88 for diesel since early July to US$1,74 this week and from US$1,77 for petrol to US$1,57 this week (see graphic).

Government, with concurrence from economic analysts, has since projected that the recent inflation spiral should retreat faster going forward, thereby boosting disposable incomes and restore purchasing power as speculative market forces are being contained by tough macro-economic measures.

Confederation of Zimbabwe Retailers chairperson Mr Denford Mutashu

Confederation of Zimbabwe Retailers (CZR) president, Mr Denford Mutashu, yesterday acknowledged that prices have generally remained higher despite reduced doing business burden on producers, leaving consumers to bear the biggest brunt.

“Some commodities are responding to the constant fuel drop in the market, but others are not. For instance, we are noticing that every week sugar pricing is increasing at a time when consumers are expecting a reduction,” he said.

“On the other hand, cooking oil prices are somehow dropping from a high of about US$57 a carton to between US$50-51.”

Mr Mutashu said there has been significant Government intervention in the market recently and noted the introduction of gold coins saying most business entities have found a safe haven for the restoration of value of the local currency.

“That has significantly reduced pressure on the American dollar, so we expect prices of basic commodities to drop soon,” he said.

“Another key issue is that of stability on the parallel market in the past three weeks, which speaks into a convergence with the official exchange rate and this should have a significant bearing on the market.

“Those businesses who were banking on speculative and forward pricing of goods and services are fast pricing themselves out of business as they are facing intense competition from small to medium enterprises who are responding to movements in the market driven by fuel pricing.”

Mr Mutashu urged businesses to build on the momentum that has been created by the Government to reduce prices in line with the drop in production costs, especially fuel.

Dr Tinashe Manzungu

Prominent Gweru businessman and Zimbabwe National Chamber of Commerce (ZNCC) past president, Dr Tinashe Manzungu, also said prices must fall in line with fuel prices.

“On the basis that prices had increased a ripple effect of fuel increase it makes economic sense that since fuel prices have now decreased prices for goods and services should follow suit,” he said.

“There is a tendency that businesses would want to profiteer. I call upon the business community to be considerate. This will help the ordinary consumer on the street to enjoy because everyone was affected by this shock.”

Consumer Council of Zimbabwe (CCZ) spokesperson, Mr Christopher Kamba, said businesses should not expose themselves through higher prices even when costs of production have gone down.

“Consumers expect a huge reduction in prices of basic commodities in response to fuel price drop. However, we are worried that a majority of businesses are in-fact increasing prices of basic commodities when fuel is reducing, which is a key component in the production chain,” he said.

“We appeal to consumers to take action and exercise due diligence when purchasing. They should select shops that offer low prices but high-quality products.

“The parallel market rate has been stable for the past few weeks now. But due to the speculative nature of businesses, which are after profits, they are punishing consumers who have a thin income base.”

Mr Kamba said as a consumer watchdog, they constantly raise their grievances with the Reserve Bank of Zimbabwe and Ministry of Industry and Commerce condemning unscrupulous business entities that are continuously increasing prices for no justifiable economic reason.

Reserve Bank of Zimbabwe (RBZ)

In response to recent concerns over exchange rate volatility versus monetary policy interventions, the Reserve Bank of Zimbabwe (RBZ) has stated that the shift towards exchange rates convergence should result in progressive decline in month-on-month inflation.

Already month-on-month inflation had dropped to 25,6 percent in July, shedding 5,1 percentage points on the June rate of 30,7 percent, according to ZimStat.

Authorities expect this to continue up to around three percent in December 2022.

“The economic outlook remains strong as the requisite economic and financial fundamentals for stability are present and past drivers of exchange rate volatility have been correctly identified and are being dealt with,” said the RBZ in position paper presented during the recent Zimbabwe Economic development Conference in Victoria Falls.

Finance and Economic Development Minister, Professor Mthuli Ncube

In an interview last week, Finance and Economic Development Minister, Professor Mthuli Ncube, also said the corrective domestic measures should quickly arrest inflation with positive pass-through impact in the form of enhanced disposable incomes and aggregate demand for businesses.

“We’re beginning to see the month-on-month inflation beginning to dip and the exchange rate beginning to hold where it is and that’s a good thing. We need that stability for us to focus on development,” he told Chronicle.

“Indeed, the increase in inflation was really beginning to erode purchasing power, incomes and demand for ordinary citizens. So, the dipping on monthly inflation downwards will go a long way to restore value to citizens’ purchasing power, and lower the cost of living once again,” Prof Ncube added.

“All this is critical in beginning to improve savings and may even encourage investments. So, all this is going in the right direction in terms of restoring purchasing power for all citizens.”

Comments