Tax reforms to boost revenue collection

Bianca Mlilo, Business Reporter

THE tax reforms highlighted in the 2017 national budget are likely to result in increased Government revenue collection, an official has said.

The Zimbabwe Revenue Authority (Zimra) has missed revenue collection targets several times and this trend has been blamed on numerous factors that include defaulting, tax evasion and concerns over restrictive tax regime.

When he presented the 2017 national budget in Parliament last week, Finance and Economic Development Minister Cde Patrick Chinamasa announced a package of tax reforms aimed at cushioning businesses and boosting domestic production.

These include elimination of double taxation on presumptive taxes payable under informal traders’ tax, a downward review on the taxes and training of SMEs on registration and filing of tax returns as well as payment of tax.

Speaking at a tax seminar hosted by the Institute of Chartered Secretaries and Administrators in Bulawayo yesterday, a Zimra official, who declined to be named for professional reasons, said the reprieve extended to the informal sector would be a game changer.

“The taxation of informal traders through improved presumptive tax collection will widen the tax base and that is where part of the growth in VAT projection comes from,” said the official.

The official said the new system encourages registration and filing of tax returns by the informal sector and as such the number of tax evaders will be reduced.

Presumptive tax has normally been paid quarterly but will henceforth be paid monthly, which means its payment will be spread across the year, making it cheaper in the long run.

The official said an upward review of duty on textiles was going to level the playing field for those in the clothing industry. He said the fiscalised tax regime was also going to ensure increased surveillance and compliance in payment of Value Added Tax (VAT), in particular.

“The VAT fiscalised recording of taxable transactions is a blessing in disguise to the Zimbabwe Revenue Authority (Zimra) because there is now little scope for individuals and businesses to avoid paying tax.

“To avoid unnecessary penalties, turnover on monthly returns should be the same as the ones in your ledger system. If Zimra finds out that your figures do not tally, you will be penalised. The fiscal machines are linked to the server at Zimra,” said the official.

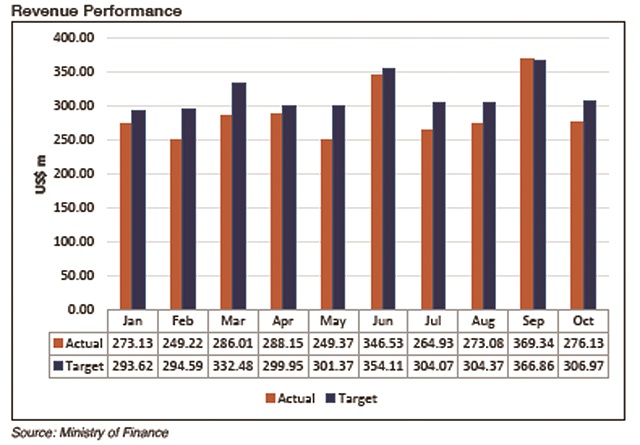

In his budget presentation Minister Chinamasa said slower growth undermined overall performance of the public finances this year, with cumulative revenues from January to October 2016 performing 1.5 percent below previous year levels, but 9.8 percent lower than budgeted estimates.

“The 9.8 percent under-performance in revenue for the period January–October 2016 left collections at $2.876 billion against a target of $3.158 billion. Resultantly, a budget revenue shortfall of $282.5 million was recorded,” said the minister.

During the meeting it also emerged that the tax collector had widened the restrictions to associate companies whose taxes are set at one percent of other allowable deductions.

“If there is a payment of management fees between a company and its associate, deduction would not be allowed in full,” said the Zimra official.

“In order to minimise tax planning initiatives that reduce the tax liability, interest on the portion of the loan that results in the company exceeding the debt to equity ratio of three to one is disallowed as a deduction against taxable income.”

The official said dividends arising from disallowed interest expenses would be excluded from the income tax exemption starting January 1, 2017.

However, the same dividend is exempt from income tax when paid by a company, which is incorporated in Zimbabwe.

@BiancaMlilo

Comments