Tax reprieve for workers

Prosper Ndlovu, Business Editor

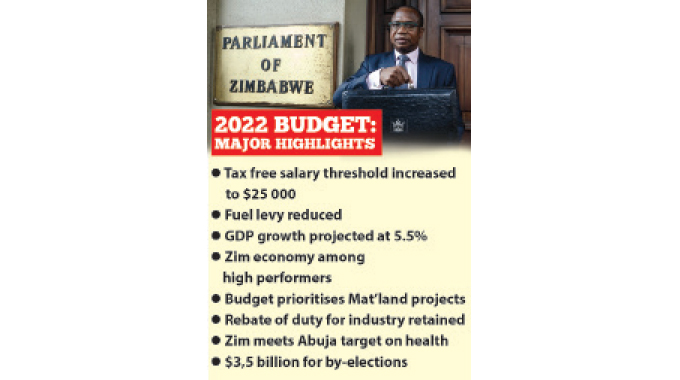

FINANCE and Economic Development Minister, Professor Mthuli Ncube yesterday unveiled a $927,3 billion budget for 2022 in which he handed down comprehensive tax relief measures to cushion workers and increased support to key sectors of the economy in order to steer the growth momentum achieved this year.

The interventions buttress the ideals of the National Development Strategy 1 (2021-2025), which is anchored on scaling up domestic productivity and building the momentum towards attainment of an upper middle-income economy by 2030.

With the economy projected to grow by 7,8 percent for the year 2021 and 5,5 percent next year, Zimbabwe is among the high performers under difficult Covid-19 conditions and well above the 3,4 percent average growth for Sub-Saharan Africa, said Prof Ncube.

This is despite the downside risks facing the economy amid the threat from the raging Covid-19 pandemic and its mutating variants.

The economy is, however, being negatively affected by erratic supply of key enablers such as electricity and water, deficiencies in delivery of social and other public services, slow implementation of value addition initiatives, and resurgence of inflation pressures.

“These challenges are being addressed under the 2022 National Budget, without losing focus on consolidating the achievements made to date in order to make the economy more resilient,” said the minister.

In order to provide relief to taxpayers and boost aggregate demand for goods and services, the minister has heeded the call to review tax bands and proposed widening of the tax-free threshold from $10 000 to $25 000.

He also reviewed upwards the local currency tax-free bonus threshold from $25 000 to $100 000 while the foreign currency tax-free bonus threshold has been moved from US$320 to US$700, with effect from November 1.

The tax relief incentives cover salary earnings in both local and foreign currency, bonus payments and retrenchment packages. The move is expected to boost consumer spending power at a time when most workers were complaining about erosion of incomes amid price increases being experienced in the market.

To buttress the same, tax bands have been adjusted to end at $500 000 above which a marginal tax rate of 40 percent will apply, with effect from January 1, 2022.

The minister has further proposed an upward review of the tax-free threshold on income accruing in foreign currency from US$70 to US$100, with effect from January 1. Other foreign currency tax bands remain unchanged.

Presenting his 2022 National Budget Statement in Parliament, the Treasury boss said the reviews were necessitated by the higher than projected wage reviews during the course of 2021 by Government and some private sector employers.

He said these have pushed a number of taxpayers into higher income tax brackets resulting in bracket creep and a higher tax burden.

“Government recognises that a number of employees have been retrenched as employers adopt cost rationalisation strategies, in response to the negative effects of the Covid-19 pandemic,” he said.

“In order to preserve value of retrenchment packages, I propose to review non-taxable portion of the local currency tax-free threshold from the greater of Z$50 000 or 1/3 of the retrenchment package, whichever is higher, up to a maximum of Z$240 000, to the greater of Z$400 000 or 1/3 of the retrenchment package, whichever is greater, up to a maximum of Z$2 million, for income earned in local currency.

This measure takes effect from 1 January 2021.”

In order to tame escalating costs of fuel, Prof Ncube said it become necessary to rationalize the fuel levies in order to mitigate the impact of fuel pricing on the economy.

“I, therefore, propose that the fuel levy be pegged at a maximum of two cents per litre for both diesel and petrol,” he said.

In view of the burden incurred by surviving spouses regarding estate duty, the minister also reviewed the tax-exempt portion of the deceased estate from $50 000 to US$100 000 or local currency equivalent thereof. The measure takes effect from January 1. Further tax credits have been extended to businesses that employ people living with disability and those championing the green economy initiatives.

Prof Ncube said the proposed $927.3 billion, which is 18.3 percent of Gross Domestic Product, falls far short of requests submitted by line ministries, departments and agencies, which were in excess of $2,7 trillion.

“Consistent with a GDP growth projection of 5.5 percent in 2022, total revenue collections are projected at $850.8 billion (16.8 percent of GDP),” said Prof Ncube.

“To complement anticipated revenue collections in 2022, Government seeks to borrow resources amounting to $76.5 billion from the domestic market and additional drawdown from the SDRs resources.

“The expenditures in 2022 are projected at $927.6 billion, with a targeted deficit of Z$76.5 billion (1.5 percent of GDP) with recurrent spending constituting 13.4 percent of GDP while capital programmes will take up five percent of GDP.”

He explained the capital budget provides an overall spending plan $334.2 billion, including devolution of $42.5 billion.

In this amount, $156.4 billion is for infrastructure delivery mainly with Z$10.9 billion being for capitalisation of State-Owned Enterprises whilst $23.5 billion has been earmarked for capacitation of line ministries.

The minister said the budget was also expected to cater for loan repayments of $28.3 billion and acquisition of financial assets of $41 billion.

To buttress the agriculture transformation, which is the mainstay of the economy, the Treasury has allocated $124 billion to the sector while an allocation of $49.4 billion goes home affairs and Z$61.5 billion for the defense sector for preservation of peace and security.

The foreign affairs sector has been allocated $14.9 billion while information and media portfolio has an allocation of $2.7 billion. Infrastructure development is key under NDS and the 2022 budget provides an overall infrastructure spending plan of $156.4 billion to support mainly ongoing projects.

The energy sector was allocated $3.9 billion while a provision of $4.7 billion goes to women affairs and SMEs with sport, art and culture getting $7.8 billion mainly for rehabilitation and upgrading of sporting facilities. The tourism sector was allocated $3.7 billion while industry got $3.9 billion.

An allocation of $10 billion goes to public service while $117.7 billion has been allocated to the health sector, Z$5.7 billion to higher and tertiary sector, $3.3 billion to the ICT sector with a total of $2.1 billion going to urban and rural local authorities.

In order to assist the retooling of companies the budget has retained rebate of duty facilities among other fiscal support measures. However, Prof Ncube bemoaned lack of transparency by some of the beneficiary businesses.

Comments