WATCH: Leather sector struggles to access US$5m package

Nqobile Bhebhe – [email protected]

PLAYERS in the leather sector have said they are struggling to access the US$5 million retooling fund availed under the IMF Special Drawing Rights, as financial institutions administrating the facility are turning down applications on account that they are not foreign currency earners.

This is despite the massive business potential the sector has with Zimbabwe being ranked first and second in Africa and the world respectively in terms of exports of exotic leather.

The leather industry occupies an important place in the Zimbabwean economy in view of its potential for higher employment, growth, and value-added exports.

It is on this basis that the Treasury has set aside US$5 million for the sector from its SDR677 million (US$958 million equivalent) from the IMF, which is part of the SDR’s General allocation of US$650 billion that was released in 2021.

While SDRs are not a currency, they are a critical international reserve asset created by the IMF to supplement the official reserves of member countries to provide liquidity.

The SDRs were meant to address the long-term global needs for reserves, building confidence and fostering resilience and stability while enabling member countries to cope with the adverse impact of the Covid-19-induced crisis.

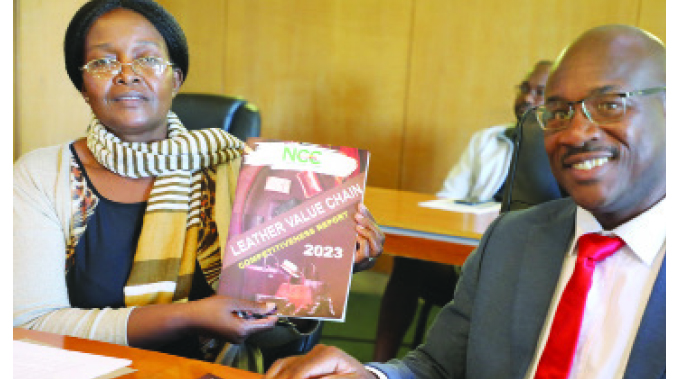

Speaking during the official launch of the Leather Value Chain Competitiveness Report produced by the National Competitiveness Commission in Bulawayo yesterday, Zambezi Tanners managing director, Mr Arnold Britten, highlighted that there were several bottlenecks in accessing the fund. He said most players were using old, inefficient machinery, which is weighing down on capacity utilisation.

“Retooling is very important, most of our tanneries started operating in the early 80s and we are now using antiquated machines. When you talk about efficiency in the factory, it is very minimum and the cost for retooling is expensive,” he said.

Zambezi Tanners general manager Mr Arnold Britten

“The US$5 million retooling fund that is said to be available to the industry, which has to be accessed through banks is not accessible. The banks say tanneries do not generate US dollar income as many tanneries are not exporting.”

Mr Britten also said the repayment tenure for the fund is too short and appealed to authorities to look into the matter.

“The tenure of the loans is very short, it is difficult to retool and how are we expected to have repaid the loan in 12 months and retool at the same time,” he said.

“Two tanneries have been turned down by two banks on account that they do not generate foreign currency.

“For us at Zambezi Tanners, it has taken us almost three years to bring all the machinery, and before even receiving all the machines you have to repay the loan.

“Therefore, the pressure to retool and repay the loans is huge, so the retooling fund is not accessed. It does not make economic sense on a business perspective to carry the amount of debt and retool at the same time,” said Mr Britten.

He said it was critical for loans to be accessed in favourable conditions that include longer repayment terms. The leather value chain is one of the crucial manufacturing sub-sectors being prioritised under the Zimbabwe National Industrialisation Development Policy (NZIDP) 2019-2023 and the National Development Strategy-1.

The new report noted that the sector is among the top 10 leather products exporters in the Sadc and Comesa region.

“The country’s crocodile sub-sector is very competitive as it is currently ranked first and second largest crocodile exporter in Africa and the world, respectively.

“This contrast to the bovine leather sub-sector, which is saddled with numerous challenges that undermine its competitiveness,” reads part of the report.

National Development Strategy 1 (NDS1)

The meeting also noted concerns over limited access to foreign currency for retooling, importation of spares, chemicals and other critical inputs in the production process.

“The prevailing interest rate of 150 percent and the short tenure of loans, hinder the players in the sector from borrowing to finance critical expenditures, thereby undermining the competitiveness of the sector,” it reads.

“Most of the plant equipment that is used locally is very old with frequent breakdowns and spares are difficult to source due to foreign currency challenges. Although some of the spares are locally available, these would have been imported and the suppliers put a premium of over 50 percent thereby making them very expensive.

“Furthermore, where the local suppliers are amenable to payment for the spares in local currency, the prices are indexed to the alternative foreign exchange rates.

Ministry of industry and commerce permanent secretary Dr Mavis Sibanda

“These factors and the maintenance and downtime costs are passed on to consumers translating to higher prices of locally-manufactured leather, and leather products (LLPs), thus, rendering the final products less competitive compared to imports.”

In a speech read by the acting director in the Ministry of Industry and Commerce, Mrs Mary Chingonzoh, permanent secretary Dr Mavis Sibanda commended the report for identifying gaps, existing opportunities and offers evidence-based recommendations.

“It’s therefore, important to note that implementation of the strategies enshrined in this report will go a long way in addressing the existing challenges in the leather value chain,” she said.

Dr Sibanda urged the sector to take advantage of the huge market by perfecting the products produced so that they are of high quality and competitive.

Comments