Zim pays $180m to Chinese firms

Golden Sibanda Harare Bureau—

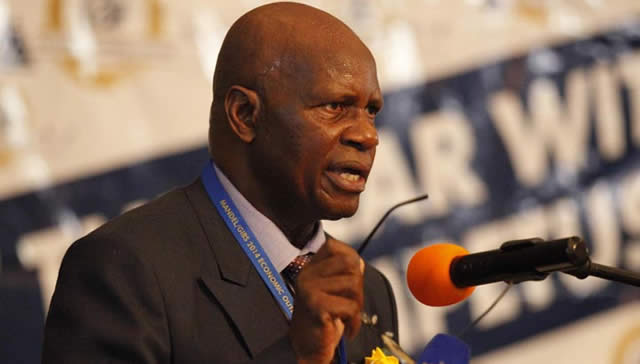

THE government has paid $180 million in part clearance of liabilities to Chinese companies in an effort to restore normal business relations to secure fresh lines of credit. Finance and Economic Development Minister Patrick Chinamasa said yesterday that he engaged Chinese firms during the recent visit to China by a government delegation led by President Robert Mugabe.

Chinamasa told a Herald Business breakfast meeting in Harare that Treasury had made token payments to demonstrate commitment to pay the debts.

“All in all, in the past six months we have had to cough up $180 million, which was not budgeted, just to make sure that we look good,” Minister Chinamasa said.

This also comes as Minister Chinamasa prepares to present to Cabinet a debt resolution strategy to the country’s debt overhang, which he said was an albatross to economic recovery.

Minister Chinamasa said apart from the token payments made during the past six months, the government had made commitments to the Chinese firms that it would assume all the debts owed by local enterprises.

The debts pertain to transactions by companies such as Ziscosteel, Farmers World and TelOne, which had not been settled and stood in the country’s way to accessing new credit.

Chinamasa said the government would assume TelOne’s $360 million debt, which resulted in a funding agreement for the company amounting to $98 million.

He said the line of credit would be applied towards the expansion of TelOne’s fibre optic network project.

Chinamasa said the government had also taken the responsibility to repay the $80 million loan for agricultural equipment which was extended to Farmers World.

This commitment has resulted in the government securing guarantees for loan facilities to support State-owned NetOne’s mobile network expansion programme.

Further, Chinamasa said he had partially settled liabilities by Zisco to Sino-Sure, which he said was critical to obtaining commercial loan facilities from China.

He said the government would first do debt validation to determine how the liabilities were accrued and loan facilities were applied.

Minister Chinamasa said all commercial deals with Chinese companies were insured by Sino-Sure, which is why it was of paramount importance to normalise relations with the company.

This comes as Treasury has engaged at least four big Chinese financial institutions to extend lines of credit to Zimbabwe.

These include Sino-Sure, China Eximbank, Industrial and Commercial Bank of China and the Development Bank of China.

During the trip to China, the government signed several multi-million dollar infrastructure financing deals, which are expected to spur economic development.

Chinamasa said while the government had secured commitment from Chinese state-owned financial institutions to support mostly public sector projects and companies, Zimbabwe would also engage Chinese financial institutions to extend lines of credit to the private sector.

He said after obtaining financing facilities from China, local companies failed to repay or did not have the courtesy to explain the challenges they were facing.

Chinamasa revealed that the government had also started making token payments to clear liabilities to multilateral institutions that include the International Monetary Fund, the World Bank and the African Development Bank.

He said although the token payments were too small for liabilities exceeding $4 billion, this represented part of efforts to normalise relations in order to access fresh lines of credit.

Comments