Zimra, BNC US$14m tax dispute drags on

Oliver Kazunga, Senior Business Reporter

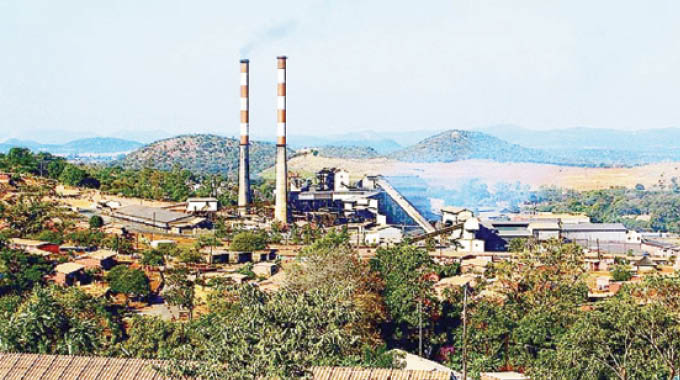

THE High Court is still to make a ruling over an outstanding US$14 million tax dispute involving Bindura Nickel Corporation (BNC) and the Zimbabwe Revenue Authority.

The tax dispute emanates from tax assessments issued in February 2018 largely in relation to legacy issues arising out of how the nickel producer was structured sometime ago.

In a statement accompanying BNC financial results for the year ended March 31, 2020, the nickel miner said:

“It was reported in the previous year that the company was involved in a tax dispute with the tax authorities emanating from tax assessments, which were issued in February 2018, amounting to approximately US$14 million.

“The tax differences mainly related to historical issues concerning how the company was structured many years ago, as well as issues arising from the varying interpretation of standard commercial agreements in the industry.”

For the outstanding amount, the two parties agreed to declare a dispute and pursue the matter through the courts.

“The matter is now before the courts pending hearing.

“Except for this disclosure, no provision has been made in this year’s financial statements with respect of this contingent liability,” said the mining corporation.

Based on legal advice received to date, the company said, it has acted within the statutes of the law and its directors were still of the view that a positive resolution will be reached.

At the time of reporting, BNC could not reasonably estimate the likely timing of resolution of the matter.

“In assessing the going concern position of the group, the directors have considered the current trading activities, funding position and projected funding requirements, particularly in respect of the main operating subsidiary, Trojan Nickel Mine Limited, for at least 18 months from the date of approval of these financial statements,” it said.

The mining group said while it earned a profit before taxation for the period under review amounting to US$2,3 million (2019: US$17,1 million) and at that date current assets exceeded current liabilities by US$3,9 million (2019: US$1,5 million), its ability to continue as a going concern was dependent on the ability to generate positive cash flows.

During the period under review, BNC sold 5 685 tonnes of nickel in concentrate compared to 6 410 tonnes sold in the comparative period in 2019.

The decline in sales tonnage was in line with production, which was lower than the prior year’s output.

World nickel prices improved leading to an eight percent year-on-year increase in the average price realised by BNC for the sale of its nickel in concentrate.

Despite the improved price performance, annual turnover of US$52,4 million was one percent lower than the US$54 million realised in the comparative period last year.

“This was in sync with the decrease in sales tonnage referred to above. Cost of sales decreased from US$40,3 million last year to US$37,7 million in the year under review, mainly due to lower production,” said the mining firm.

Gross profit increased by seven percent from US$13,7 million in the comparative period last year to US$14,7 million.

In the outlook, BNC said the world economy is effectively on hold, despite the efforts of several central banks to provide economic stimuli and fiscal support to citizens and corporations who have been adversely affected by the Covid-19 pandemic.

“The market’s direction will depend on the demand/supply balance.

“The demand side will depend on how fast economies re-open and the supply side will depend on the extent of the total reduction in supply due to national lockdowns, which have forced mining houses to either stop or reduce production,” it said. — @okazunga

Comments