$653m NRZ recapitalisation loan deal ‘almost complete’

Martin Kadzere Harare Bureau

THE National Railways of Zimbabwe is on the verge of concluding a $653 loan with the Development Bank of South Africa for recapitalisation. “The rail network signals rehabilitation are 60 percent complete while negotiations for a $653 million loan with DBSA for recapitalisation of NRZ are at an advanced stage,” according to a progress report on the implementation of ZimAsset.

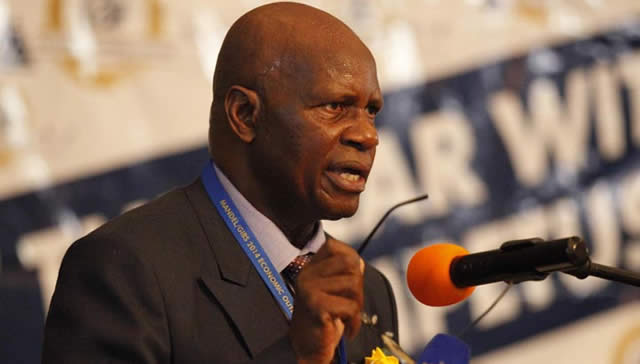

In an interview yesterday, Minister of Transport and Infrastructural Development Obert Mpofu said the deal was “almost complete.” The deal was structured in a similar way to the model used for funding of rehabilitation of Plumtree-Bulawayo-Mutare highway where the loan would be repaid using revenue collected from toll gates.

The $653 million loan to the NRZ would be repaid using revenue from rail services.

The DBSA provided about $206 million loan for the rehabilitation of the 823 kilometre Plumtree-Bulawayo-Mutare highway and the project is almost 95 percent complete.

Minister Mpofu said almost all approvals required to “consummate” the NRZ loan have been obtained.

The rail network is critical to the growth of the country’s domestic, regional and international trade as it provides bulk transport for raw materials and finished goods.

The decline in capacity from 18 million tonnes to the current 3,8 million tonnes has meant that goods that should have been transported more conveniently by rail are being moved long distances by road, thereby increasing the cost of transporting products.

Finance and Economic Development Minister Patrick Chinamasa said while the 2015 Budget would support the NRZ rehabilitation programmes with a provision of $3 million from tax revenues, the bulk of the money would be mobilised from the private sector.

He said NRZ would leverage its assets to mobilise funding for upgrading infrastructure maintenance which require $388 million and operating assets ($265 million).

Minister Chinamasa said the company was also engaging private investors to expand the system to new economic settlements not serviced by the current network.

Comments