7 Osiphatheleni arrested over illegal POS machines

Peter Matika – [email protected]

POLICE in Bulawayo have launched a probe into the criminal activities of illegal foreign currency dealers who are using Point of Sale (POS) machines and so far seven osiphatheleni have been arrested.

In recent months, illegal forex dealers have resorted to using POS machines for transactions involving large sums of money.

The machines, with logos of various financial institutions, are used to lure clients in a bid to “formalise” illegal transactions.

Transacting illegally in forex is in violation of the country’s money laundering and Exchange Control Regulations.

The illegal activities fuel foreign exchange instability and is to blame for sustained loss of value of the local currency.

In Bulawayo as of yesterday, the black market rate was at US$1:$4 000 while the official rate trailed behind at US$1:Z$1 800.

Seven illegal foreign currency dealers have so far been arrested in Bulawayo, following the launch of a police operation targeting foreign currency dealers.

“We have launched an operation targeting these illegal foreign currency dealers, who are now daring to the extent of displaying Point of Sale (POS) machines. This is unheard of and we will not let such crimes go on unnoticed. We will get to the bottom of this and bring all who are involved to justice,” said Bulawayo Provincial spokesperson Inspector Abednico Ncube.

He said police retrieved 11 POS which are the property of NMB and Steward banks.

Inspector Abednico Ncube

“We are launching investigations into how these foreign currency dealers got their hands on these machines. Whoever is involved will have a case to answer,” said Insp Ncube.

The arrested foreign currency dealers that were found in possession of NMB and Steward banks machines include Tatenda Makore (27), Blessing Siziba (24), Obey Dliwayo (45), Blessing Moyo (42), Everisto Chiyangwa (39), Simbarashe Njanji (26) and Reward Chigudu (45), who was found in possession of three unregistered machines.

Insp Ncube said the use of POS machines by illegal foreign currency dealers was among some of the major causes of the rise in rates.

“The latest developments where the illegal money changers use point of sale machines has seen their activities going out of hand, blocking pavements and operating as though everything is legal.

NMB Bank

“The practice also becomes a security threat as robbers may target such open illegal banking systems. Police will conduct operations to safeguard the lives and incomes of innocent people,” said Insp Ncube.

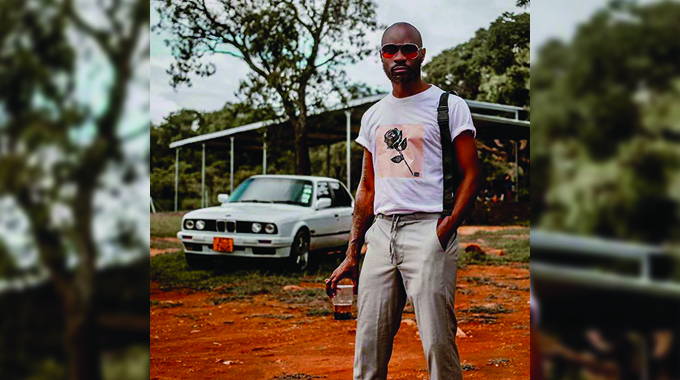

Illegal forex dealers are now a regular feature at almost every street corner in Bulawayo.

While most illegal money changers operate from cars in areas surrounding Tredgold Building, several others have set up permanent spots where they openly trade in public.

So brave are the illegal money changers that they conduct their business right in front of the Magistrates’ Courts and are usually indifferent in the presence of police officers.

Some are found along Leopold Takawira Avenue between Fort Street and Joshua Mqabuko Nkomo Street while others have drifted to George Silundika Street between 10th and 11th Avenue.

These are popular with members of the public who prefer the higher rates offered as opposed to the official rate in the formal market.

Last week our news crew sought to establish how POS machines are obtained from financial institutions and their conditions of usage as per the agreements signed.

Posing as an entrepreneur at one of Zimbabwe Stock Exchange-listed financial houses, one official outlined to the reporter the process of obtaining a POS machine.

“First of all, you need to open a company bank account with us, providing the bank with your certificate of incorporation, CR14, CR6, a tax clearance certificate, memorandum and articles of association,” said the official.

“We need to have sight of your minutes of the previous meeting, copy of identity documents, company profile and a deposit of $18 000.

“The whole process takes less than a week and we will issue you with POS machines depending on the number you require,” said the bank official who was generous enough to provide his contact details “for further assistance”.

However, a document provided, which relates to the POS merchant agreement, details the usage of the gadgets and measures to be taken for violating the agreement. For instance, the document states that: “the equipment will be delivered by (name of the Bank supplied) to the delivery address.”

Money changers with POS machines in Bulawayo

“Bank at its own cost, provides telecommunication equipment to link the equipment to the merchant.

“The Merchant shall not remove the Equipment from the delivery address or relocate it anywhere else without the prior written approval of the Bank,” reads one section.

On the part of the merchant, the document states that: “the Merchant will always keep the equipment fully charged, where applicable and in a safe place at the delivery address and ensure that it is used with due skill and care, and only in the manner and for the purpose for which it is designed and intended in accordance with the business of the merchant.

Bankers Association of Zimbabwe

“The Merchant shall ensure that the equipment is always operated in accordance with the law . . . where the equipment is used to commit fraud or bank reasonably suspects the existence of fraud or nefarious conduct in respect of the provisions of this agreement, Bank may terminate this agreement without giving the Merchant any notice and will be entitled to recover the equipment immediately.”

Investigations revealed that some retail outlets were reportedly hiring out their gadgets to money changers for a fee while some directly engage osiphatheleni to conduct illegal forex trading on their behalf.

Bankers Association of Zimbabwe (BAZ) chief executive, Mr Fanwell Mutogo said they are not aware of the practice to use the machines by illegal forex dealers.

Comments