Bright spots for African miners

James Patterson and Hannah Clarke

There is no denying that 2015 was a rough year for miners across Africa.

Still, though precipitous falls in the price of most minerals put pressure on investors and governments alike, there is some good news, according to Analyse Africa, a data service from the Financial Times.

Despite serious economic headwinds, investors can take heart in the fact that there is still a fair amount of domestic growth across the region.

Africa’s economy is predicted to grow by around 4.16 percent in 2016 – the second highest of any world region.

The Democratic Republic of the Congo (DRC), which has mineral reserves with an estimated value of $24 trillion (including a 20 percent share of world diamond reserves), is expected to grow by seven percent in 2016.

It is also the largest producer of copper in Africa, and accounts for nearly 6 percent of world production.

In recent years, there has been a significant increase in production levels, escalating on average by 33 percent per year between 2010 and 2014.

Improving security and infrastructure have helped.

In Mozambique, the top exported products are all mined minerals and metals, including raw aluminium and petroleum.

Economic growth is predicted to be around 8.2 percent through 2016 – the fastest of any African country.

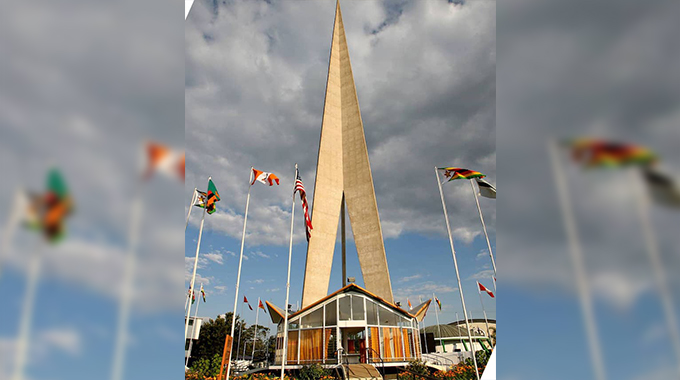

Zimbabwe, a producer of platinum, has seen an upturn in production increasing its share of world production from under 5 percent in 2010 to nearly seven percent in 2014.

This has been boosted by continued foreign investment in the industry. In 2015, Russian investors announced a $4bn platinum mine project, with output expected to reach 800 000 ounces per year by 2024.

Slowing of demand for raw materials globally can also highlight opportunities for African producers to further grow the mining industry by mobilising resources towards manufacturing finished products.

Some countries have successfully integrated this secondary sector, where profit margins are higher, into their economies.

Botswana, home to the world’s richest diamond mine in terms of rough diamonds produced, has more than 20 cutting and polishing plants in-country.

Despite forecasts indicating a narrowing of prices of polished diamonds compared to rough diamonds, Botswana’s cutting industry is still expected to generate $1 billion in revenue for 2015.

However, there is no question that many mining dependent economies are facing tough years ahead.

In addition to external shocks, Africa faces the challenge of dependence on raw materials for its export market, leaving it reliant on demand for those exports.

China replaced the US in 2009 as Africa’s main trading partner.

Exposure to China’s weakening external demand will not be easy to cope with for many African countries.

The value of total exports from Africa into China fell by 20 percent in 2014.

Mauritania’s iron ore and copper ore exports, which comprise 96 percent of its total export trade value with China, have fallen 49 percent and 27 percent respectively between 2013 and 2014.

Though more diversified both in terms of its export partners and its industries, South Africa’s economy is suffering.

It is the world’s largest producer of platinum, producing an estimated 110 000kg in 2014, and accounting for around 70 percent of world production.

Exports of platinum accounted for just over seven percent of exports in 2014, a fall from around 11 percent in 2010.

A major factor contributing to this decline was the five-month long mine workers strike, which was eventually resolved with salary increases for the lowest paid workers.

For, Zambia copper exports are extremely important, accounting for 4 percent of world production.

The mineral’s production has grown by an average of more than seven percent per year between 2010 and 2014, and now account for almost three-quarters of the country’s total exports.

Although the outlook in previous years has been positive, 2015 has been a struggle with falling prices and large producers such as Glencore cutting back on production.

The Zambian mines minister, Christopher Yaluma, launched Konkola Copper Mines’ ‘Chingilila’ initiative to try and protect the industry.

The initiative’s main objective is to improve work practices and safety, leading to greater efficiency.

Mr Yaluma sees this as key to the long-term sustainability of the entire mining industry in Zambia.

The gold industry in Africa, in particular, highlights raw minerals’ vulnerability to external price shocks.

The fall in prices since 2011, coupled with intensifying labour disputes in South Africa, has led to a decrease in production.

The country has historically been the world’s leading producer, peaking at 64 percent of total production in 1983.

However ageing mines, increasing electricity prices, and fewer new discoveries have led to a drop in market share to the sixth highest producer globally.

China now produces 450 metric tons of gold per year – three times more than South Africa in 2014.

Still, there is hope that South Africa’s gold export market might rebound.

India, South Africa’s second largest gold importer by trade value, increased imports of the metal after the South African Reserve Bank eased restrictions coupled with low prices.

This is Africa and Analyse Africa are media partners for the African Mining Indaba. — Africa Online

Comments