Banking deposits up 8,4pc

Oliver Kazunga Senior Business Reporter

BANKING sector deposits have increased by 8.3 percent to $5,2 billion in the first 10 months from $4.8 billion during the same period last year.

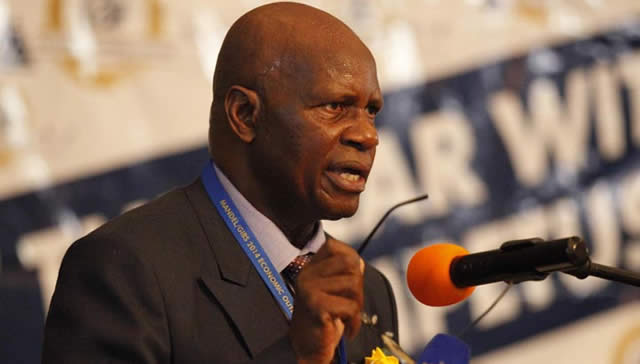

Presenting the 2015 national budget last week, Finance and Economic Development Minister Patrick Chinamasa said long-term deposits were beginning to show signs of growth.

“Banking sector deposits increased by 8.3 percent . . . to $5.2 billion over the year to October 2014. Growth during the corresponding period last year was 7.9 percent.

“Long-term deposits are also beginning to show some signs of growth, increasing from $700.9 million in October 2013 to $1.02 billion by October 2014,” he said.

“However, demand deposits continue to dominate, comprising close to 48.6 percent of total banking sector deposits. Long-term deposits are 19.4 percent while those under 30 days account for 19 percent and savings deposits13 percent.”

Chinamasa said as at the end October 2014, total banking sector loans and advances grew by 6.2 percent to $3.86 billion against $3.64 billion in October 2013.

“The banking sector’s lending remains largely skewed towards unsecured loans to individuals due to associated low risk as repayments are deductions at source,” he said.

The minister said a number of reforms were being instituted to strengthen the banking sector.

The reforms, he said, had been necessitated by the need to strengthen the regulatory and supervisory framework as well as enhance financial stability.

Chinamasa said Diaspora remittances were projected to decrease by six percent in 2015 from $890 million this year to $840 million.

He attributed the decrease to the projected slowdown of the South African economy, where many migrant Zimbabweans were working.

“Diaspora remittances remain a critical source of liquidity in the market and the government will continue to put in place effective systems to encourage use of formal channels by the people in the Diaspora,” Chinamasa said.

He said the financial system remains generally stable reflecting on-going initiatives to restore confidence in the sector.

The initiatives relate to capitalisation of the Reserve Bank of Zimbabwe, government assumption of the central bank debt, resuscitation of interbank trading, and resolution of non-performing loans, among others.

The government intends to inject between $150 million and $200 million to recapitalise RBZ.

The central government has announced plans to assume the financial institution’s $1,35 billion debt that it incurred a few years ago before the adoption of a multicurrency system when it was involved in quasi-fiscal activities.

Comments