Banking sector scoops $503bn annual profits

Nqobile Bhebhe, Senior Business Reporter

ZIMBABWE’S banking sector recorded aggregate profits of $503,13 billion for the year ended 31 December 2022, which translates to a 748,59 percent increase from $59,29 billion reported in the corresponding period in 2021.

According to the Reserve Bank of Zimbabwe (RBZ), the growth of the sector income largely emanated from non-interest income, which constituted 67,82 percent of total income as at 31 December 2022, up from 54,35 percent reported in the corresponding period in 2021.

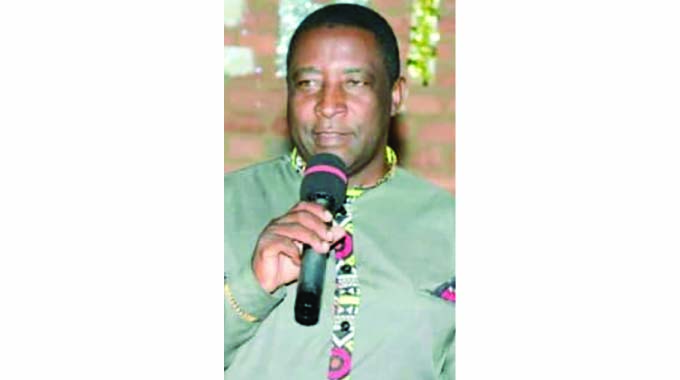

“The sector largely remains safe, sound and well-capitalised to continue playing its key role of facilitating economic recovery while having adequate capacity to absorb unexpected shocks or losses,” Reserve Bank of Zimbabwe (RBZ) Governor, Dr John Mangudya said.

In his 2023 Monetary Policy Statement issued last Thursday, he said as at 31 December 2022 the banking sector was adequately capitalised with all banking institutions complying with the prescribed minimum capital adequacy ratio of 12 percent and tier one ratio of eight percent.

Dr Mangudya said the average capital adequacy and tier one ratios were 37,15 percent and 26,92 percent, respectively with key statistics pointing to a viable sector.

“The banking sector remains safe and sound and continues to play an important role in the recovery and growth of the economy.

“Aggregate core capital increased by 114,62 percent from $284,74 billion as at 30 June 2022 to $611,11 billion as at 31 December 2022,” he said.

Reserve Bank of Zimbabwe (RBZ)

Dr Mangudya said the growth in core capital was mainly attributed to the capitalisation of retained earnings (including revaluation gains from investment properties, translation gains from foreign exchange-denominated assets) and capital infusion by shareholders.

“The banking sector capital position is considered adequate to absorb unexpected shocks or losses as well as ensuring business continuity,” he said.

The number of building societies reduced from five to four following the merger between CBZ Bank and CBZ Building Society, effective 30 September 2022 and consequently the cancellation of the building society’s licence.

CBZ Holdings

Following the central bank’s pre-opening inspection, which assessed Time Bank’s readiness to conduct banking business, the banking institution was authorised to recommence some banking business effective 27 October 2022, bringing the number of operating commercial banks to 14.

Time Bank was authorised to conduct limited banking activities and is not permitted to take deposits from the public in line with its business strategy and having regard to the institution’s risk management structures and processes, level of capitalisation as well as corporate governance arrangements.

According to the monetary statement, 15 out of 18 banking institutions (excluding POSB) reported core capital levels that comply with minimum capital requirements.

POSB

Standard Chartered Bank is also finalising its recapitalisation processes pending the disposal of the institution by its shareholders.

Dr Mangudya said the current minimum capital requirements for all categories of banking institutions and microfinance institutions will be maintained.

“Recognising that the non-compliant institutions are at various stages in implementing their recapitalisation initiatives, the bank will extend the compliance deadline to 31 December 2023 to allow for the completion of the recapitalisation processes currently underway,” he said.

Dr Mangudya said in this regard, no banking institution or microfinance institution whose core capital is non-compliant with the prescribed minimum capital requirements shall pay dividends to its shareholders unless it has taken adequate steps to comply with prudential requirements, including capital adequacy, and has been granted approval by the Bank.

He said the capital position of ZB Building Society is dependent on the outcome of the current strategic initiatives within the group.

ZB FINANCIAL Holdings

Total deposits increased by 103,57 percent from $1,12 trillion as at 30 June 2022 to $2,28 trillion in December 2022 mainly driven by growth in foreign currency deposits.

Dr Mangudya said commercial banking sub-sector deposits constituted 91,15 percent of total banking sector deposits while foreign currency deposits accounted for 64,24 percent of total deposits as at 31 December 2022.

Comments