More women access loans

Nqobile Bhebhe, [email protected]

WOMEN accessing loans from microfinance institutions reached 149 235 as at 31 December 2023, reflecting an 8,8 percent increase, with the value of loans to female borrowers amounting $286,67 billion from $157,32 billion, the new Monetary Policy Statement shows.

Presenting this inaugural Monetary Policy Statement last week, Dr John Mashayavanhu said in the period under, the number of active clients accessing loans through microfinance institutions increased by 12,21 percent from 298 023 as at 30 June 2023, up to 334 423 as at 31 December 2023.

“The industry also recorded an 8,88 percent increase in the number of women accessing loans, from 137 063 up to 149 235 as at 31 December 2023, and the value of loans to female borrowers over the same period increased by 82,22 percent, from $157,32 billion to $286,67 billion as at 31 December 2023,” he said.

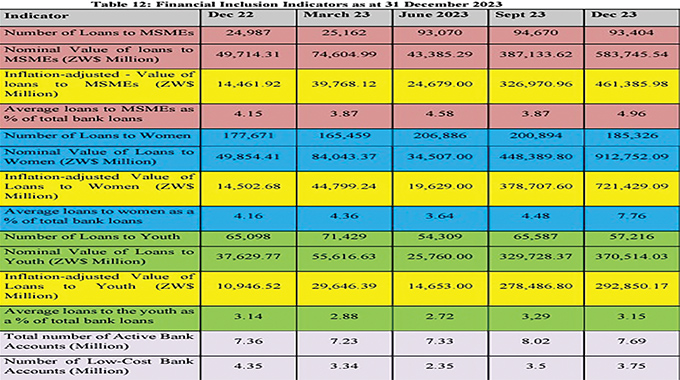

On financial inclusion indicators, Dr Mashayavanhu noted that access to credit improved during the year ended 31 December 2023, as indicated by the significant increase in the real value of loans to women, which registered a 90,50 percent increase from $378,71 billion as at 30 September 2023, to $721,43 billion as at 31 December 2023.

The increase was partly attributed to the operationalisation of the collateral registry system, which facilitates the usage of moveable assets, particularly by women who previously lacked collateral to secure funding from financial institutions.

“As at 31 December 2023, loans to women accounted for 7,76 percent of total banking sector loans, up from 4,48 percent in the previous quarter.

“In addition, real value of loans to MSMEs and Youth increased from $326,97 billion and $278,49 billion as at 30 September 2023, to $461,39 billion and $292,85 billion as at 31 December 2023, respectively.”

Financial inclusion is defined as the availability and equality of opportunities to access financial services.

It refers to a process by which individuals and businesses can access appropriate, affordable, and timely financial products and services.

Government launched the National Financial Inclusion Strategy II (NFIS II) in 2022 to deepen the use of financial products in the informal sector, to achieve the aspirations of the National Development Strategy 1 (NDS 1) and make those in the sector more prosperous as a result.

NDS1, among other priorities, aims to eradicate poverty and empower women, and youths, promote sustainable livelihoods for the less privileged and support people living with disability.

NFIS II rides on the successful implementation of (National Financial Inclusion Strategy I (NFIS I) that ran between 2016 and 2021, focusing more on access to financial services by the low-income and marginalised groups such as women, youths, rural communities, smallholder farmers as well as micro, small and medium enterprises.

The proportion of loans to MSMEs compared to total banking sector loans increased from 3,87 percent to 4,96 percent while the proportion of loans to youth compared to total banking sector loans marginally declined from 3,29 percent to 3,15 percent for the same period.

The MPS noted that the number of active bank accounts marginally declined from 8,02 million as at 30 September 2023, to 7,69 million as at 30 December 2023, while low cost accounts increased from 3,5 million to 3,75 million during the same period.

In the period under review, the microfinance sector registered a 32,77 percent increase in aggregate equity from $301,14 billion as at 30 June 2023 to $399,83 billion as at 31 December 2023.

The increase was attributable to organic growth, fresh capital injection by some microfinance institutions’ shareholders and currency translation gains.

A total of 35 credit-only microfinance institutions were non-compliant with the minimum capital requirements of local currency equivalent to US$25 000.

“The non-compliant institutions are putting in place re-capitalisation strategies to comply with the prescribed minimum capital requirements and enhance their capacity to underwrite more meaningful business” noted the governor.

Four out of seven operational DTMFIs were non-compliant with the new minimum capital requirement of ZW$ equivalent to US$5 million for deposit-taking microfinance institutions.

This was largely attributable to persistent losses since inception by the respective DTMFIs, thereby depleting institutions’ capital.

The central bank continues to engage the institutions and shareholders of the non-compliant DTMFIs as they implement various capital-raising initiatives, Dr Mashayavanhu said.

Dr John Mashayavanhu

The loan portfolio for the sector increased by 78,93 percent from $418,37 billion as at 30 June 2023, to $748,60 billion as at 31

December 2023. The aggregate industry total loans of $748,60 billion comprised $342,57 billion (54,97 [percent) for consumptive loans and $337,13 billion (45,03 percent) for productive loans.

According to the MPS, the microfinance sector registered significant progress with an aggregate net profit of $402,64 billion for the year ended 31 December 2023, from $12,10 billion recorded during the comparable period in 2022.

The increase was largely attributed to the revaluation of trading assets held in foreign currency.

“Confidence in the deposit-taking microfinance subsector continues on an upward trend as reflected by a 104,72 percent increase in deposits over the review period from $53,35 billion as at 30 June 2023 to ZW$109.22 billion as at 31 December 2023.”

Comments