Fracas as Kingdom clients demand their money

Loveness Bepete Chronicle Reporter

FURIOUS Kingdom Bank account holders yesterday damaged electronic glass doors at the bank’s Jason Moyo Street branch in Bulawayo demanding their money after the institution limited cash withdrawals.Angry depositors said they had been sleeping outside the bank since last week in a bid to get served.

They told Chronicle the bank has, since July, been allowing its clients to withdraw only $50 a day and charging an unexplained $3 for withdrawals.

Kingdom Bank spokesperson Sekai Chitemerere said liquidity constraints in the local economy had affected normal operations, forcing the introduction of daily withdrawal limits to ensure everyone got something.

Pamela Moyo said she left her home at around 3am.

“I have been coming here for the past two weeks but still there is no money. Sleeping here has been useless as I still get nothing out of it,” said Moyo.

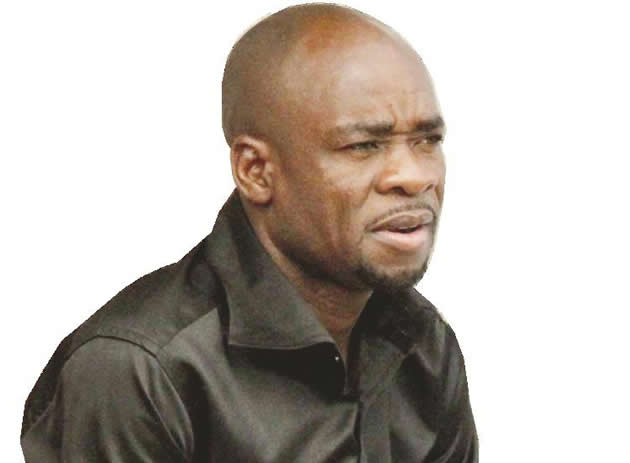

Another depositor said the bank had failed to explain what the problem was to fuming depositors, choosing instead to call anti-riot police to disperse them on Friday. “We have been coming here since last week but we are not getting any explanation from the management. We are disappointed that they called riot police instead of explaining to us,” said Essau Majaya.

Heads of schools and teachers who refused to be named said examination preparations were being hindered by the bank’s failure to provide adequate money. They said pupils were losing learning time as teachers spend days queuing for money.

Chitemerere said: “We are working flat out to normalise the situation of cash availability on various platforms including Zimswitch for our clients’ convenience and as an effort to ensure all clients have access to available cash.”

Five of the bank’s branches have been shut down countrywide.

The branches include Belmont in Bulawayo, Ruwa, Chitungwiza, Victoria Falls and Newlands.

“We have already embarked on a major rationalisation programme aimed at stabilising the business, focusing on cost containment, optimising resources, identifying growth opportunities in the financial service sector and five of our branches have already been affected,” said Chitemerere.

Comments