Caledonia enters ‘cap and collar’ hedge contract

Oliver Kazunga, Senior Business Reporter

RESOURCE group, Caledonia Mining Corporation, has entered into a “cap and collar” hedge contract with an undisclosed financial counterpart over 20 000 ounces of gold produced over a five-month period.

A hedge arrangement is a financial instrument in this case between Caledonia and its unnamed financial counterpart.

It is entered into to offset financial risk as the mining group believes that the hedge provides greater certainty to its cash flows during the period of the arrangement.

In a statement yesterday, Caledonia, which owns the Gwanda-based Blanket Gold Mine in Matabeleland South province said: “The company has entered into a zero-cost contract to hedge approximately 25 percent of 2022 target gold production at Blanket via a cap and collar hedging contract for 20 000 ounces of gold over a period of five months from March to July 2022.”

The hedging contract has a cap of US$1,940 and a collar of US$1,825.

This means that, for the 4 000 ounces of gold per month for the five-month period, Caledonia would receive an effective gold price per ounce of not less than US$1,825 or greater than US$1,940 and will receive an effective spot gold price between these two levels.

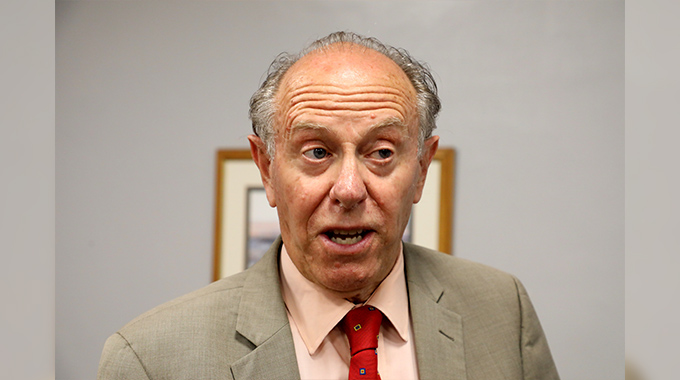

Commenting on the announcement, Caledonia chief executive officer Mr Steve Curtis said hedging gold production was not an easy decision for a gold miner.

This is on account that investors usually wish to maximise exposure to gold price upside.

“However, given the fact that our capital expenditure phasing is heavily weighted towards the first half of 2022 as we ramp up gold production, the board considered it prudent to take advantage of the current strong gold price to protect the balance sheet during this phase of higher capital investment with a five-month hedging arrangement over a portion of our production,” he said.

Meanwhile, in 2016 Caledonia announced a similar arrangement when it entered into a “cap and collar” hedge over 15 000oz production using a “collar” value of US$1 050 per ounce and a cap value of US$1, 080 per ounce.

Last year, Caledonia attained a record high of 67 474oz, which was above its revised increased guidance of 67 000oz.

The latest output figures also reflect a 17 percent improvement from the 2020 production levels on the back of a US$67 million Central Shaft project at Blanket Mine with the mining group now targeting 80 000oz annually beginning this year going forward.

– @KazungaOliver.

Comments