High-Level Debt Resolution Forum on the cards

Nqobile Bhebhe, Senior Business Reporter

ZIMBABWE is planning to host a High-Level Debt Resolution Forum with development partners and other stakeholders aimed at building consensus on the process and procedures of resolving the country’s external debt and arrears clearance.

The country’s external debt continues to burden the economy by restricting access to low cost, long-term financing required to support the desired medium to long term growth trajectory.

To address the challenge, Finance and Economic Development Minister, Professor Mthuli Ncube said the Government has developed the Arrears Clearance, Debt Relief and Restructuring (ACDRR) Strategy aimed at restoring debt sustainability.

According to the strategy document, the country is ready and geared for private sector-led inclusive economic growth.

In his 2022 Mid-Term Fiscal Policy Review Statement in Parliament last Thursday, Professor Ncube, in line with the ACDRR Strategy, Government will soon host a High-Level Debt Resolution Forum with development partners and other stakeholders aimed at building consensus among all stakeholders on the process and procedures of resolving the country’s external debt overhang and arrears clearance.

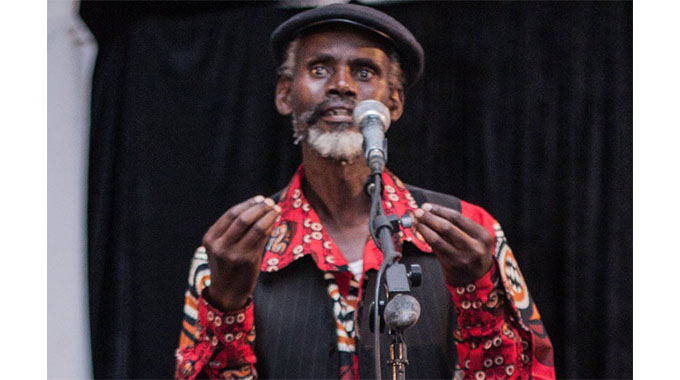

Dr Akinwumi Adesina

“The African Development Bank’s President, Dr Akinwumi Adesina has agreed to be the country’s Champion for the Debt Resolution and Re-engagement process. In his capacity as Champion, he will coordinate and chair the forthcoming High-Level Debt Resolution Forum,” said the minister.

The strategy document adds that the engagement of the AfDB president to act as Zimbabwe’s champion would need the country to be on track in implementing a comprehensive reform programme backed by the International Monetary Fund (IMF) and the World Bank Group.

“The main objective of the Forum will be to build consensus among all stakeholders on the process and procedures of resolving Zimbabwe’s unsustainable external debt overhang and arrears clearance, as well as updating development partners on the economic and political situation in Zimbabwe, including progress with the reform program,” the document says.

The strategy document states that the arrears clearance and eventual access to new financing will provide momentum for economic reforms and private sector investment for the country to attain Vision 2030.

According to the document, the urgent conclusion of a debt resolution strategy is critical in regaining access to concessional financing from both multilateral and bilateral development partners.

International Financial Institutions (IFIs)

The clearance of the arrears to the International Financial Institutions (IFIs) and Paris Club requires a comprehensive, well-coordinated approach, including strong support from all creditors, it said.

In a show of commitment to clear the debt and in line with the Government’s re-engagement commitment, token payments to the International Financial Institutions amounting to US$1,6 million per quarter, were resumed in March 2021.

Token payments amounting to US$100 000 per quarter are being made to each of the 16 Paris Club bilateral creditor beginning in September 2021 — a total of US$1,6 million per quarter.

“Arrears remain a major challenge to the economy, making up over 77 percent of total external debt. Almost all external debt owed to multilateral development financial institutions (MDBs) is now in arrears, (World Bank Group, US$1,4 billion or 88 percent, African Development Bank, US$681 million or 95 percent and European Investment Bank, US$344 million or 95 per cent),” he said.

The external debt is weighing down heavily on the country’s development needs and will continue to negatively impact on the country’s ability to meet the SDGs targets, especially in health, education, social protection and bring down the levels of extreme poverty.

“The lack of access to international financial resources to finance Zimbabwe’s economic recovery from the Covid-19 pandemic and NDS1 priority projects and programmes will continue to affect the country’s capacity to achieve its inclusive economic development goals, especially infrastructure investments, and climate change mitigation and resilience.

“The continuing accumulation of arrears is also seriously undermining the country’s credit rating and is severely compromising the country’s ability to attract foreign direct investment, as well as to mobilise direct budget and balance of payments support.”

The document adds that without debt resolution, debt distress and arrears accumulation will continue to hinder the post-pandemic economic recovery and transformation.

Covid-19

“As Zimbabwe exits both crisis — debt crisis and Covid-19 pandemic crisis, its recovery should leverage on digital and green investments to facilitate strong, sustainable and inclusive growth.

“Arrears clearance, debt relief and restructuring will, therefore, ensure sufficient resources for economic recovery post the pandemic, especially concessional support from bilateral development partners and creditors, including IFIs.” — @nqobilebhebhe

Comments