Nedbank eyes VFEX listing

Nqobile Bhebhe, Senior Business Reporter

NEDBANK Zimbabwe has indicated its intention to list on the fast-growing Victoria Falls Stock Exchange (VFEX) next month.

At the moment the bank’s shareholders only trade shares on the Johannesburg Stock Exchange (JSE) through Corpserve Nominees, hence listing on the VFEX will afford Nedbank shareholders a localised exit mechanism.

The USD-denominated VFEX is a subsidiary of the ZSE launched in 2020 as an off-shore biased financial services centre as part of efforts to attract global capital and restore foreign investor confidence in Zimbabwe’s capital markets and help companies raise capital in foreign currency.

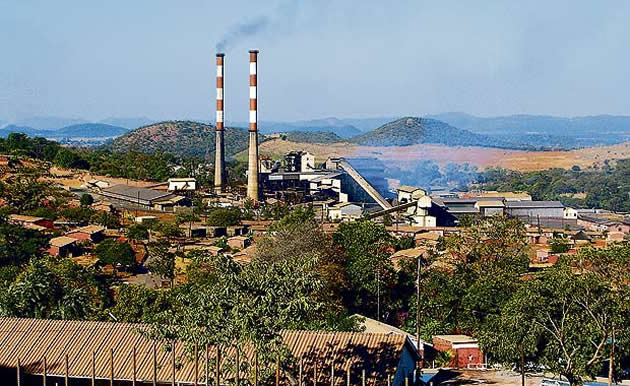

At its inception VFEX began trading with leading seed producer and distributor, SeedCo International Limited with mining giant Caledonia Mining, skins and meat processor — Padenga and Bindura Nickel Corporation coming on board later.

Bindura Nickel Corporation

Fast food service group Simbisa Brands Limited has also indicated its plans to list.

In an abridged pre-listing statement, Nedbank said local shareholders who are interested in trading their equity securities in Zimbabwe should convert their Nedbank shares into Nedbank depository receipts to be issued and listed on the Victoria Falls Stock Exchange (“VFEX”).

“As Nedbank was not listed in Zimbabwe, it contracted Corpserve Registrars (“Corpserve”) to set up a share dealing service to facilitate trading by their Zimbabwean shareholders on the JSE,” reads the statement.

“In compliance with tax and exchange control requirements in South Africa, shareholders on the Zimbabwe branch register had to receive their shares through a nominee facility that met the legal requirements of South Africa.”

To this end, Corpserve structured a nominee arrangement, through Corpserve Nominees (Private) Limited (“Corpserve Nominees”), a company that then complied with the required legal requirements on behalf of the thousands of shareholders on the Zimbabwe registers.

“Consequently, Nedbank shareholders that wish to sell their shares are only able to do so through this facility that captures and provides an order management and trade routing facility to the JSE through an intermediary also appointed by Nedbank,” said the bank.

The institution said on March 11, 2016, Old Mutual Plc announced its strategy of ‘Managed Separation’ as the board believed that the long-term interests of Old Mutual Plc shareholders and other stakeholders would be best served by separating the four businesses then owned by the Old Mutual Plc group.

It was envisaged that the structure at the time trapped value and inhibited the efficient management and funding of the growth and potential of the four strong individual businesses comprising the group.

On the benefits of the Zimbabwe Depository Receipts (ZDR) model, the financial institution said the model will unlock liquidity in Nedbank as participants will have coordinated entry and exit mechanisms.

Comments