US$5m retooling package excites leather sector

Sikhulekelani Moyo, Business Reporter

THE leather sector expects to derive maximum benefit from the US$5 million value chain retooling package allocated to them by the Treasury using resources under the International Monetary Fund (IMF) Special Drawing Rights (SDRs).

Zimbabwe was allocated SDR677 million (US$958 million equivalent) by the International Monetary Fund (IMF), which is part of the SDR’s General allocation of US$650 billion that was released in 2021.

It is from these resources that the Treasury channelled part of the funds towards supporting key economic sectors such as horticulture, industry retooling, tourism, and smallholder farming irrigation systems.

A total of US$80 million has been set aside for productive sector funding and the Government has invited local businesses to start accessing the money to boost the country’s economy.

According to a recent Treasury statement, those eager to access the revolving facility, should submit an application letter through selected participating banks for assessment.

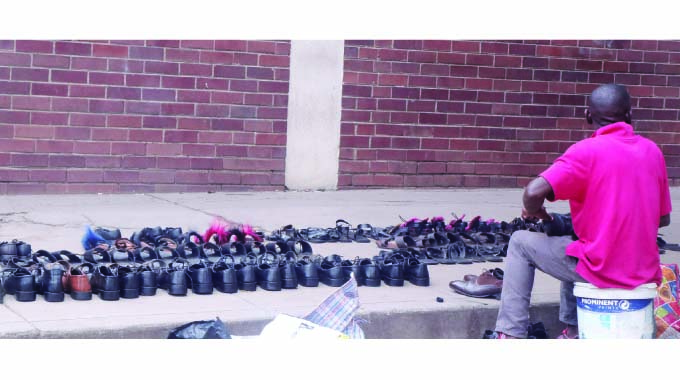

Leather shoes on the street

The banks will then forward the letter accompanying the support for the project to the Treasury through the respective ministry.

The breakdown of SDR disbursements towards the productive sector includes; a US$30 million horticulture revolving fund, a US$22,5 million industry retooling for value chain revolving fund, US$7,5 million tourism facilities services development/ upgrading revolving fund, and the smallholder farmers irrigation infrastructure development fund to the tune of US$20 million.

From US$22,5 million for industry retooling and value chain, the funds have been allocated to the following value chains; US$5 million each for the cotton sub-sector, leather and pharmaceutical companies, US$4 million for fertiliser and US$3,5 million for other agro-processing.

Commenting on these facilities, Bulawayo Leather Cluster secretary-general, Mr Fungai Zvinondiramba, said the revolving fund package would impact positively the sector and paid tribute to the Government.

“This is the first time as an industry we get such kind of support from the Government and we welcome it as it will go a long way in building the leather industry,” he said.

“It’s our duty as a nation and private sector to build industries that will then create employment, especially for the leather value chain, which is a very low-hanging fruit. We thank the Government for this intervention.

“As we were discussing, we found out that some of our tanners have been crying for retooling as some of their equipment is now very old and we thought the money will be channelled to that. Also, for our manufacturing side, they need working capital to boost their production so that they enjoy economies of scale.”

However, Mr Zvinondiramba urged the Government to ensure the cost of the funding is affordable to businesses and consider facilitating speedy release of the resources to the qualifying applicants.

Zambezi Tanners’ general manager, Mr Arnold Britten, also said the SDR allocation was a noble gesture by the Government saying the revolving fund will go a long way in assisting local companies in retooling.

Money – Image taken from Pixabay

He, however, said there is a need to review the export retention levels on foreign receipts saying the company has to first be able to generate sufficient extra foreign currency to facilitate loan repayment.

“At the current 60/40 retention ratio, there is no adequate funding to address operational expenses and loan repayments.

“If that issue could be addressed, this would go a long way in seeing a quick turnaround of the leather value chain,” said Mr Britten.

“Given that the leather value chain forms one of the pillars of the economic blueprint, we look forward to a favourable outcome on this matter to allow the value chain to contribute to the economic recovery effectively.” — @SikhulekelaniM1.

Comments