ZSE welcomes new ETF listing

Harare Bureau

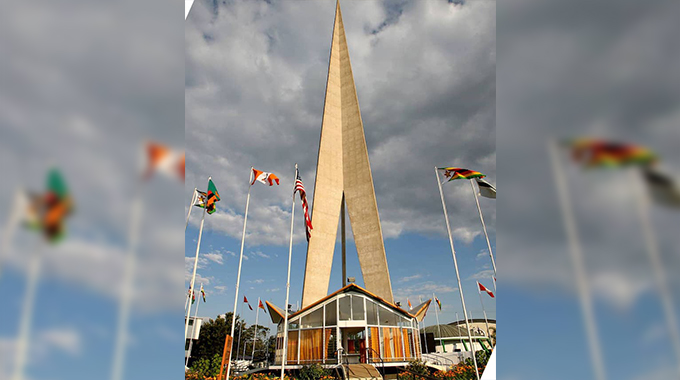

THE Zimbabwe Stock Exchange yesterday welcomed a new Exchange Traded Fund (ETF) listing while another one is waiting for the Securities and Exchange Commission of Zimbabwe’s approval.

An ETF is a basket of securities that can be purchased or sold on a stock exchange the same way a regular stock can.

ETFs can be passive (tracking an index) or actively managed as is the case with the new listing.

The listing of the Morgan & Co Multi-Sector Exchange Traded Fund (ETF) brings to two the number of ETFs on the ZSE following the listing of the Old Mutual Top 10 ETF last year.

Speaking at the listing ceremony in Harare, guest of honour and one of the most active stock market investors on the ZSE, Dr Solomon Guramatunhu, said the year 2022 was set to be an interesting year for market participants given the launch of the Morgan & Co Multi-Sector ETF.

Dr Guramatunhu said investing and saving is critical for a developing economy like Zimbabwe given that it promotes capital formation, creates employment opportunities, and controls excess liquidity.

“The Morgan & Co Multi-Sector ETF has therefore been established to serve as an effective mechanism for investing and saving,” he said.

Dr Guramatunhu said the Morgan & Co ETF is a unique proposition given that the active management aspect is based on continuously making decisions on the underlying portfolio instead of tracking a benchmark index.

He said there is a good opportunity for making market-beating returns, unlike passive ETFs which can only match a given market index.

In his remarks, Morgan & Co Head of Research, Batanai Matsika said the ETF “is a cheaper way of getting access to a wider range of stocks and sectors.

“It makes it a very relevant product for retail as well as institutional investors.”

Mr Matsika said there is still room for development in terms of deepening local capital markets.

Listing of ETFs broadens the local stock market known for years as “a market of shares”, according to the Securities and Exchange Commission of Zimbabwe’s (SECZim) chief executive Tafadzwa Chinamo who also spoke at the event.

“The ZSE has a lot of innovations and wants to make the market as accessible to just about everyone and everywhere with as much ease as possible and ETFs I think are part of that,” he said.

Mr Chinamo said the thrust at SECZim is investor education, deepening the market and getting more people involved and speaking to them through ETF is a much easier way of doing it.

He said success of the instrument will be based on the number of people who will be involved in trading the ETF.

Mr Chinamo also revealed that another ETF was already at his desk waiting for approval.

He called for more such products to be brought to the capital markets.

In her remarks at the official listing ceremony, ZSE board chairperson Caroline Sandura said the Morgan & Co Multi-Sector ETF is the first-ever actively managed ETF to list on the ZSE.

The Old Mutual Top 10 ETF is passive and tracks the ZSE’s Top 10 index.

“As the ZSE we are pleased that as the market we have managed to grow the ETF space using our own resources and skills.

“Other markets in Africa had to import ready-made ETFs from the JSE to kick start their ETF markets. This shows that as a market we have come a long way and should be proud of ourselves,” she added.

Mrs Sandura said the addition of the Morgan & Co ETF will be another reason for the retail market (individuals) to try investing on the ZSE as it offers diversification and lowers investment costs.

She called for the introduction of other instruments such as ETNs (Exchange Traded Notes) and derivatives. The Morgan & Co ETF starts trading today.

Comments