Biometric payroll suggested as solution to ghost workers

Harare Bureau

The government should introduce a biometric payroll system to rid itself of ghost workers, a senior economist with the Labour and Economic Development Research Institute of Zimbabwe has said.

An audit of the civil service conducted last year unearthed a number of anomalies including the issue of ghost workers.

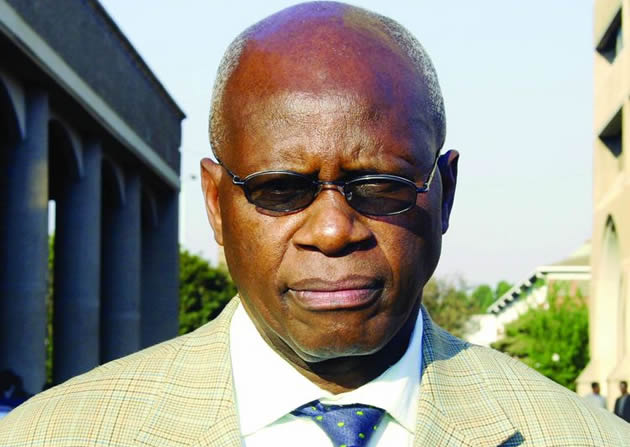

Addressing delegates attending a validation workshop on wage structure and labour cost study organised by the National Economic Consultative Forum (NECF) in Harare last Thursday, Prosper Chitambara said ridding the State of ghost workers would significantly cut the wage bill.

“The government should introduce a biometric payroll system which has been implemented in a number of African countries such as Ghana, Nigeria and Kenya as part of its payroll audit,” said Chitambara.

He said through the use of biometrics, public service employees and pensioners can be accurately identified and ghost workers will be removed from the payroll.

He said Nigeria and Kenya which had implemented the system to strengthen their public payroll administration had reduced their public sector wage bill by 20 percent and 25 percent respectively.

Last year the government introduced an audit of the payment system of State enterprises and parastatals but the exercise is yet to yield tangible results as senior officials still earn salaries way above what was recommended by the government.

Chitambara said the government should also consider reducing the number of ministries.

“This is motivated and justified in terms of the size of the economy as well as the relatively small population,” he said.

“Countries such as Sierra Leone and Uganda have taken the bold action to abolish about a third of their ministries,” he said.

The country is experiencing economic challenges that have seen treasury at times battling to raise salaries for civil servants.

Meanwhile, the Zimbabwe National Financial Inclusion Strategy (ZNFIS) which was introduced in the tobacco sector this season will be extended to other sectors as the government increases efforts to address liquidity challenges, a senior government official has said.

Presenting a paper on the effects of Zimbabwe’s current economic challenges on development and national security at the National Defence College last Thursday, Finance and Economic Development Minister Patrick Chinamasa said the Reserve Bank of Zimbabwe launched ZNFIS in March this year to promote access to financial services by the disadvantaged, under-served and excluded members of the society.

The financial inclusion strategy saw tobacco farmers being paid through bank accounts instead of getting cash as they used to. The farmers’ accounts will not attract any charges and the RBZ made it easier for those without accounts to get them. For a tobacco farmer to have a bank account, he or she produces a grower’s numbers and national identity card.

“As part of government efforts to promote financial inclusion, a payment facility has since been introduced for tobacco farmers. There are no spot cash payments; instead the payments will be made into the farmers’ bank accounts with an understanding that there would be no bank charges raised on such accounts.

“We’re going to extend this to other sectors especially to the Grain Marketing Board for the payment of farmers. It will be extremely difficult to address liquidity challenges for as long as the economy remains cash based.

“The Central Bank is exploring ways to promote the use of plastics money to address this practice,” he said.

Minister Chinamasa said heavy reliance on cash based transactions continued to put pressure on the country’s financial system.

He said the new payment system will also promote a culture of saving.

“We can’t continue with a habit of doing all transactions in cash. We’re taking steps to encourage the use of the banking system to have a formal economy.

“Eventually tobacco growers will access credit. An economy that doesn’t lend will not grow. We’re also going to expand this system to other sectors such as the Grain Marketing Board,” he said.

Comments