BNC to dismiss 350 workers

Oliver Kazunga Acting Business Editor

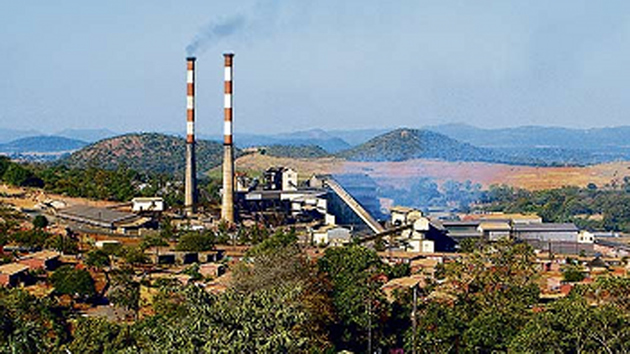

BINDURA Nickel Corporation (BNC) plans to further reduce its workforce by 350 workers as the company continues with a restructuring exercise expected to result in a leaner labour structure.

Mwana Africa, which has changed its name to Asa Resource Group Plc, said its local subsidiary BNC as part of the restructuring programme, had commenced farming activities on the land it owns in Bindura.

“As part of group cost saving initiatives, the company intends to further reduce its headcount by 350 to around 1,150 people.

“The company has commenced farming activities on the land it owns in Bindura to generate income that is not connected to its mining activities,” it said in a statement accompanying the group’s financial results for the half year ended September 30, 2015.

Asa Resource also said following board and management changes coinciding with the general meeting held on June 9, 2015, it has implemented a number of initiatives to reduce costs, re-organise the corporate structure and bring about necessary cultural changes.

The group’s net loss for the period amounted to $4.3 million compared to $7.7 million profit in the prior period which included once-off retrenchment and restructuring expenses of $1.5 million and was a lower loss than the guidance figure of $5 million released on November 26, 2015.

Asa Resource said at Bindura, a new mining plan had been adopted and a number of cost saving initiatives have been implemented to reflect a weaker nickel price environment.

“The impact of the plan is that high grade ore will be mined earlier than envisaged in the original plan and less of the disseminated ore will be extracted. Production is expected to increase in the second half of the year and the company expects that the nickel division will become profitable in the second half of the year even at current nickel prices.”

During the period under review, the group’s revenue decreased by 28 percent to $61.9 million compared to $85.8 million in the prior period.

This was despite a 17 percent increase in gold sales as commodity prices were substantially weaker over the period and nickel sales fell 29 percent due in part to a major planned shut down at the Trojan Mine.

“Operating efficiencies are being addressed under a new mine plan which the company believes will drive improvements in the nickel division in the second half of the financial year.”

The group’s executive chairman Yat Hoi Ning in a commentary said: “We’ve not been immune to the stresses that have emanated from the declines in virtually all commodities markets, particularly the global markets for gold and nickel, our principal products. Our response has been to sustain margins by containing unit costs by, where possible, simultaneously increasing production and maintaining tight control of overall costs.

“This was clearly shown at Freda Rebecca where, comparing this year’s first half with last year’s, a 17 percent increase in the number of ounces sold more than counteracted the 10 percent drop in gold’s price per ounce.”

Comments