MINISTER TAKES BOND NOTE FIRE: MPs grill Chinamasa on ‘dead rubber’ public hearings

Zvamaida Murwira, Harare Bureau

The Presidential Powers (Temporary Measures) Act promulgated by the Government giving legal effect to bond notes was done ‘‘out of abundance of caution’’ as there was already existing legislation to support the decision to bring on board the surrogate currency, a Cabinet Minister has said.

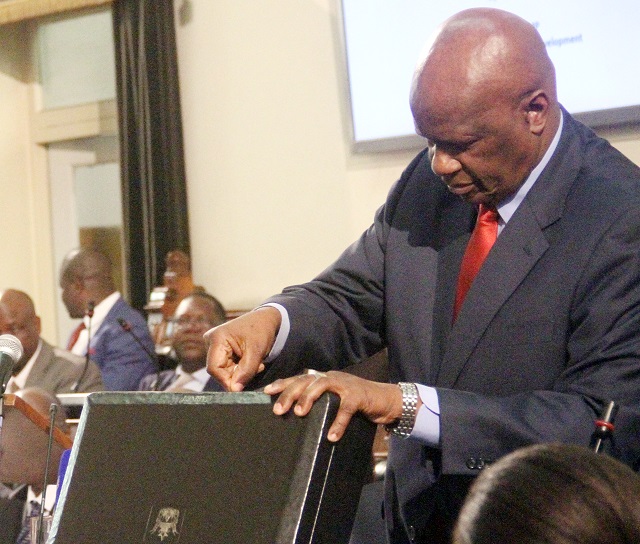

Finance and Economic Development Minister Patrick Chinamasa said, the Reserve Bank Act empowered the apex bank governor Dr John Mangudya to introduce the bond notes but the Government went out of its way to promulgate another legal instrument as a precautionary measure.

Minister Chinamasa said this in the National Assembly yesterday while fielding a barrage of questions from lawmakers.

Members of Parliament, mostly from the MDC-T wanted to know why the Government introduced bond notes at a time when parliament’s portfolio committee on Budget and Finance was seeking people’s views on the issue.

Mutare Central MP Mr Innocent Gonese (MDC-T) said the views of the people would be made redundant as it was already a fait accompli (mission accomplished), while Mabvuku-Tafara MP Mr James Maridadi (MDC-T) said the consultations being made countrywide by the committee were a “dead rubber” since the bond notes were already in circulation.

“The legal framework on bond notes is that they have been issued under existing legislation. In order to reinforce it, we came up with Presidential Powers (Temporary Measures). If someone wanted to challenge it, we were standing on two legs, the existing one and the Presidential Powers Act. So the legislation is already there but out of abundance of caution we introduced the Presidential Powers,” said Minister Chinamasa.

The response did not, however, go down well with legislators who argued that it was a waste of resources for legislators to consult the public on an issue that had already been decided before the affected people’s views was heard.

Gutu Central MP Cde Lovemore Matuke (Zanu-PF) said his assessment had shown that the bond notes had not done enough to end queues.

Minister Chinamasa said the central bank had issued $12 million into the market and would consider increasing it in a manner that was not inflationary.

“We’re aware that the $12 million bond notes issued aren’t meeting demand. The RBZ didn’t want to create a situation that is inflationary. Their needs will be met in due course,” said Minister Chinamasa.

He said the Government was aware that each time there was a new development, there would be teething problems in the market.

Minister Chinamasa was responding to a question from Marondera Central MP Cde Lawrence Katsiru (Zanu-PF) who complained that some shops were rejecting the bond notes while others had a two tier pricing structure.

Earlier on, Vice President Emmerson Mnangagwa said the central bank was empowered by the relevant legislation to enter into agreements with multilateral financial institutions for the good of the country.

He was responding to concerns on why the Government had not brought to Parliament the $200 million Afreximbank loan facility that anchored the bond notes.

Comments