Platinum output set to rise

Harare Bureau

Harare Bureau

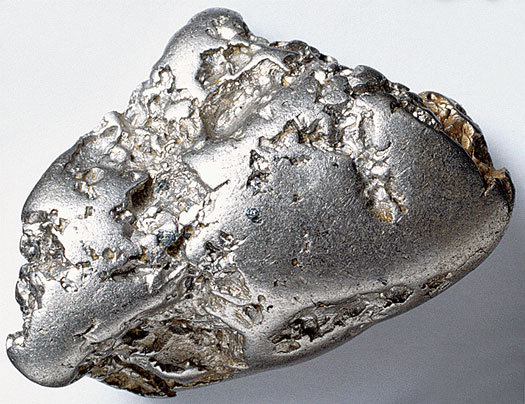

ZIMBABWE’S platinum output is expected to rise this year on the back of increased production at the country’s platinum mines.

According to Platinum 2013, a report by Johnson Mathey PLC, Zimbabwe would benefit from reduced production in South Africa. “There is no sign of any intent by the mines’ South African parent companies to alter their production plans in this relatively low cost mining area,” the company said.

The challenges within South Africa’s platinum industry has seen production going down and this could present Zimbabwe with an opportunity to export more platinum.

“The year 2012 saw an exceptional disruption to platinum mining in South Africa. At least 750 000 oz of production was lost to strikes, safety stoppages and mine closures,” the report said.

According to the report, Zimbabwe produced 340 000 ounces of platinum last year but production at the three platinum mines has since increased and Zimplats’ Ngezi mine’s plan to increase platinum production to 270 000 oz annually by 2015 is on schedule.

Improvements in capacity utilisation at Mimosa last year enabled the mine to achieve 108 000 oz of platinum concentrate. The mine is now operating at full capacity and production is expected to be flat this year.

“Anglo American’s Unki Mine has recorded a swift ramp up to full production levels. In 2012, the mill processed 1,54 million tonnes of ore, up 20 percent compared to the previous year,” the report said.

Output at the mine is expected to increase again this year.

Statistics from the chamber of mines show that platinum output is expected to grow to 12 500 kg from 10 525 kg as the three major companies, Zimplats, Unki Mine and Mimosa are investing millions of dollars in expanding operations. The firms which have complied with the economic empowerment regulations by disposing of 51 percent stake in their operations to locals, have pledged to restore mining industry growth.

In the four months to April 2013, platinum production was at 4 727 kg and the mineral dominated Zimbabwe’s mineral exports with $210 million followed by gold at $124 million and diamonds fetching $113,7 million.

Global demand for platinum has been robust in the past decade, driven by the rapid expansion of Chinese automobile industries which consume the bulk of the metal.

And Zimbabwe, which has the world’s second largest platinum resources after South Africa, is set to benefit from the boom.

Despite rising production costs arising from a 60 percent increase in electricity charges, a 100 percent rise in royalty fees and a more than 1 000 percent increase in ground rental fees, the platinum mining sector in May last year accounted for 30 percent of the $1,5 billion in export receipts after gold which contributed 55 percent.

The Chamber of Mines says by the end of 2012, mineral exports accounted for more than 50 percent of annual exports in Zimbabwe. Platinum, together with gold and diamonds, accounted for over 90 percent of the value of minerals exported during the period.

The share of the mining industry to the country’s Gross Domestic Product has increased from an average of 10,2 percent in the 1990s to above 15 percent in 2012, overtaking agriculture, which was once the backbone of Zimbabwe’s economy.

The mining sector continues to lead the country’s economic recovery since 2009, with an average annual growth of about 30 percent.

The sector is forecast to grow 17.1 percent this year from the 10.1 percent achieved last year.

However, analysts say the mining sector might not meet the 17 percent growth target projected by Government due to softer international commodity prices and local systemic factors such as inadequate energy and suboptimal cost structures.

Comments