RBZ needs $250m to recapitalise

Restore lender of last resort role

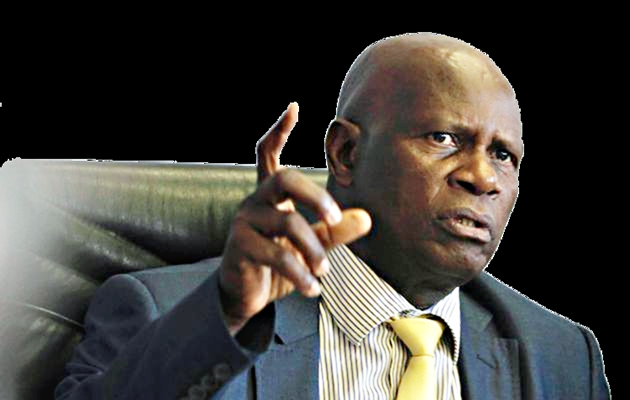

Business Editor

ABOUT $250 million is required to recapitalise the Reserve Bank of Zimbabwe (RBZ) and restore its lender of last resort role, which is key to developing a sound financial services system for economic growth, Finance Minister Patrick Chinamasa has said.

Backing the adoption of the RBZ Debt Assumption Bill in Parliament on Tuesday, Chinamasa said cleaning up the balance sheet of the central bank must be prioritised before injecting funding for its recapitalisation.

“We need something like $250 million to capitalise the Reserve Bank. Just imagine putting $250 million into a balance sheet which has a $1.35 billion debt, it makes no sense,” he said.

“Burdened with a $1.35 billion debt on its (RBZ) balance sheet, it means we’ve no sound financial services system. The Reserve Bank is the pillar of the financial services sector.

“We all agree that the balance sheet must be cleaned. After cleaning the balance sheet, we can now capitalise the Reserve Bank.”

The proposed legislation, which is before Parliament, provides for settlement of liabilities amounting to $1,35 billion incurred by the apex bank during the Zimbabwe dollar era.

The Bill has already passed the Constitutional test as the Parliamentary Legal Committee has stated that it does not violate the country’s supreme law although in some quarters ethical considerations have been raised on the pending voting in Parliament.

Treasury has already availed $100 million to capitalise RBZ, which is set to resume its lender of last resort role mid this year.

“Currently the Reserve Bank is receiving a subvention from Treasury to keep it afloat. We’re paying something like $2 million or so a month to keep it afloat but that is not how it should be. It’s that way because primarily, as you know, it makes a big chunk of its monetary role by not being able to print money,” Chinamasa added.

He said while central banks everywhere in the world were making money from printing money and lending through interbank lending systems, RBZ was not doing so because of capitalisation constraints.

The minister said those with objections to the adoption of the Bill must consider the bigger picture and the economic wisdom of cleaning the RBZ balance sheet.

“Let the past be lessons for the future so that we avoid those things that we think we did wrong in the past. I want to say that the future for us is beckoning and we must seize the opportunities that are being presented and not spend our time looking into the past,” he said.

Responding to views that an investigation should be carried out to verify and validate purposes and beneficiaries of the debt, Chinamasa said a Bill would be tabled in Parliament in due course to facilitate the setting up of a Zimbabwe Debt Management Office in the Ministry of Finance, which would undertake the task.

He said the proposed government takeover of the RBZ debt would pave way for increased confidence in the financial sector and the role of the central bank to effectively superintend over it.

Comments