They are here: RBZ releases bond notes into market today

Oliver Kazunga/Mashudu Netsianda, Senior Reporters

THE Reserve Bank of Zimbabwe (RBZ) is set to release bond notes into the market today in a move that is set to stimulate economic growth and ease cash shortages.

RBZ Governor Dr John Mangudya said the bond notes were being released through normal banking channels in small denominations of $2 and $5 to fund export incentives of up to five percent which will be paid to exporters of goods and services and diaspora remittances.

The RBZ will release bond notes worth $10 million into the market starting today with the withdrawal limits set at $50 per day and $150 weekly.

The notes will be pegged at 1:1 against the US dollar.

A new $1 bond coin has also been introduced.

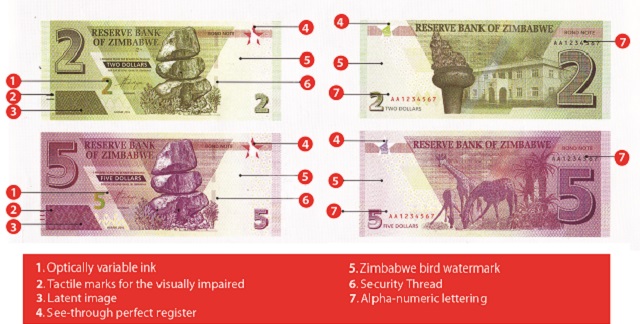

The $2 bond note is green and has images of balancing rocks on one side and the independence flame on the other.

The purple $5 bond note has balancing rocks and three giraffes.

Security features on both notes include a Zimbabwe bird watermark, see-through perfect register, tactile marks for the visually – impaired, security thread, alpha-numeric lettering and optically variable ink.

The chairperson of the Parliamentary Committee on Finance and Economic Development, Cde David Chapfika, said bonds notes would help stimulate the growth of the economy through increased export earnings.

It is also envisaged that the bond notes will help ease the prevailing cash shortages the country has been experiencing since April this year.

Cde Chapfika, a former Deputy Minister in the Ministry of Finance, urged Zimbabweans to embrace the bond notes despite negativity by some sections of society and opposition parties.

“The bond notes will promote exports and help boost the economy as well as stabilise the supply of money on the market. Exporters will not necessarily use the bond notes, but they will be credited into their accounts exchangeable at par value with the United States dollar,” he said.

Cde Chapfika said the bond notes would operate in the same manner as the bond coins.

“For instance, a retailer will order cash from his or her bank and get it in a mixture of US dollars and bond notes and coins. The introduction of bond notes is a corrective measure to ensure that a smaller trader is not inconvenienced by the unavailability of notes and coins,” he said.

“Bond notes will not be given to exporters directly, but the Reserve Bank of Zimbabwe will deposit them into the United States dollar accounts of the beneficiary exporters.”

The past president of the Zimbabwe National Chamber of Commerce, Mr Luxon Zembe, said monetary authorities should stick to their promise that there will be no printing of more bond notes which will impact negatively on inflation.

He said if the RBZ manages the bond notes well, everything would go according to plan.

“The fear that people have is not about the bond notes themselves but the fear is about the ability of the monetary authorities to manage their circulation by not printing more of them which will impact negatively on inflation. If inflation starts rising that will have negative implications on people’s wealth as their wealth will get eroded,” Mr Zembe said.

Dr Mangudya is on record as saying the bond notes, which are guaranteed by a $200 million Africa Export Import Bank (AfreximBank) facility, will see about $75 million worth of the surrogate currency being released into the economy.

Opposition parties and organisations such as #Tajamuka and other civic groups have of late been at the forefront of trying without success, to mobilise ordinary citizens to resist the introduction of bond notes through mass protests and court challenges.

President Mugabe gazetted Statutory Instrument 133 of 2016 which provides a legal framework for the introduction of bond notes as acceptable legal tender in Zimbabwe.

SI 133 of 2016 Presidential Powers (Temporary Measures) Amendment of the Reserve Bank of Zimbabwe Act, empowers the central bank to issue out bond notes using its preferred design, form and material.

As part of its constitutional obligation to facilitate public consultation in the legislative and other processes of Parliament, the Portfolio Committee on Finance and Economic Development is inviting all relevant stakeholders and members of the general public to submit comments to Parliament on this Reserve Bank of Zimbabwe Amendment Bill. The committee will also conduct public hearings countrywide beginning today. – @okazunga —

@mashnets

Comments