ZSE industrial index sinks to lowest level

biggest loss since the beginning of the year.

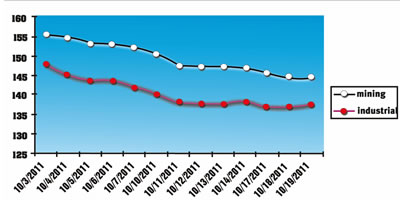

Yesterday, the market fell for the 13th consecutive day in the month after shedding 0,13 percent to sink to its lowest level of 144.34 points this year.

The market is trading in the negative territory on lack of positive stimuli following conflicting remarks about the empowerment policies with the MDC-T reportedly admitting it was opposed to the economic empowerment.

The other partners, Zanu-PF and MDC-M insist there is no going back on empowerment drive.

Uncertainty still shrouds the implementation of the empowerment laws, given the lack of liquidity and funding mechanisms to allow for market-based transactions.

But foreign companies operating in Zimbabwe have started moving towards compliance, with the first being platinum giant Zimplats, which ceded a 10 percent stake to the Mhondoro-Ngezi Community Share Trust.

Yesterday, the main index was dragged down by losses in Natfoods closing US5c less at US90c.

Financial institution, Interfin, dropped a cent to close at US14c and milk processor, Dairibord came off US0,90c to close the day at US19,10c.

There was very little movement among the big capitalised companies, with most of them trading flat, except for Barclays and Old Mutual, which both shed US0,05c to close at US6,50c and US130,5c respectively.

Aico gained US0,10c to close at US21,10c. The bearish heavily capitalised counters dragged the industrial index further, on the back of growing fears of a double dip on global markets.

The mining index has seen marginal gains in the past two trades, with Bindura propping up the index to 137,57 points.

Freda Rebecca, a sister company of Bindura, has seen production in the quarter to September moving up 13 688 ounces, representing a 66,4 percent increase from June figures of 8 824 ounces.

On the other hand, Bindura’s main cash cow, Trojan Nickel Mine, is still under care and maintenance with the bulk of the US$10 million funds raised by the company from shareholders earmarked to continue financing the care and maintenance programme.

In the past 90 days, Falcon Gold has gained 129 percent to US8c while RioZim has been the worst performer, dropping 62 percent to US55c.

The company has maintained that it has secured an underwriter for its proposed rights offer.

Initially the company wanted to raise US$40 million but the figure has since been revised downwards.

Comments